WHY TRUST US? The ZenMaid team has eight current and past cleaning business owners, including our CEO and founder Amar, who know the ins and outs of the maid service industry like the back of their hands. They share their expertise with us in product development, with the customer success team, and content, which includes the article you’re about to read. We also partner with some amazing leaders in the cleaning industry, like Debbie Sardone, Angela Brown, Courtney Wisely, Chris Schwab, and more, to provide you with the latest industry insights. The tips and advice you’ll find on our blog have helped our team grow their maid services, and we’re excited to share them with you to help you grow your business too.

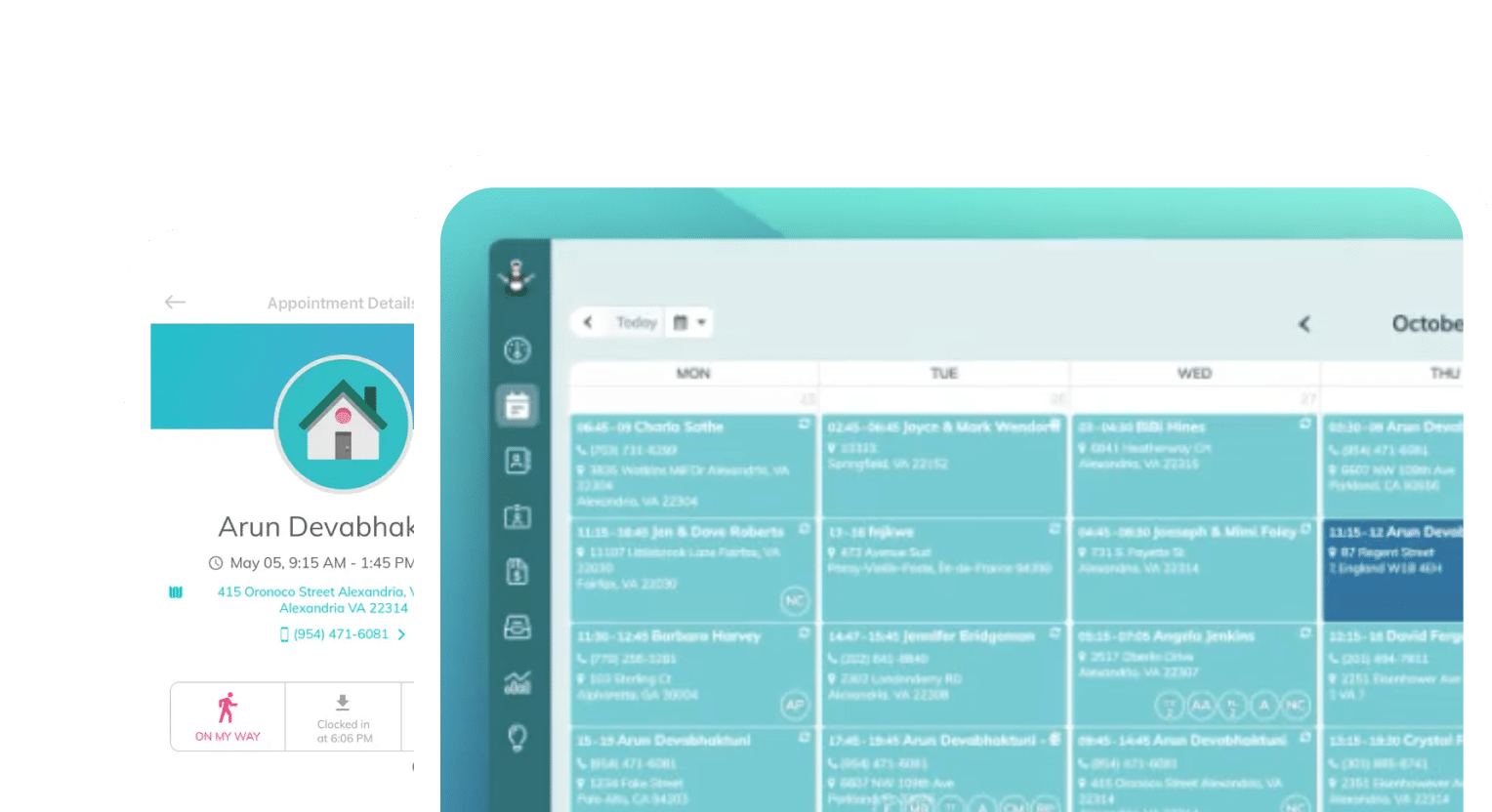

ZenMaid is the simple scheduling software that will help you save 30+ hours in your cleaning business every week. Join thousands of other cleaning business owners who now have time to take a nap, spend time with their family and take vacations! Start your free 14-day trial today to discover how many hours you can get back in your week.

In the cleaning industry, entrepreneurs often ask, “How do I determine the value of my cleaning company, and how can I sell it effectively?” Valuing and selling a cleaning company involves many considerations, including financial health, operational efficiency, industry trends, market value, and “good ‘ole closing sales techniques. This guide will give you a great foundation for navigating these challenges — from understanding your company’s worth to attracting potential buyers.

💡Expert Insights: Throughout this article, you’ll see expert tips from our very own Maria Dorian. Maria is a member of our ZenMaid executive team, and has successfully built and sold a cleaning business. You’re going to gain a lot of great takeaways from her insights!

Table of contents

- Understanding the Value of Your Cleaning Company

- Preparing Your Cleaning Company for Sale

- Attracting Buyers and Mastering the Sales Process for Your Cleaning Company

- Navigating the Sales Process of Your Cleaning Company

- Platforms to Post Your Business for Sale

- Common Mistakes to Avoid and Legal Considerations

- Wrapping Up

- Your next step

Understanding the Value of Your Cleaning Company

Determining the value of a cleaning company involves multiple factors. From a financial perspective, potential buyers will scrutinize your financial statements, profitability, and revenue growth rate. Companies with strong financial performance and growth potential usually fetch higher prices.

💡Expert Insight: “When I was selling my company, my broker was also working with a seller who did 2 million in sales. That company lost a potential deal because their books were a mess. Keep clean books! Nothing loses trust faster than a discrepancy in financial statements.

They will also scrutinize the owner’s role in a company. New buyers do not want to spend money to, in essence, buy a job. One factor that led to my company’s quick sale (and an outright bidding war!) was my ability to take a lot of vacations, and the company still performed efficiently and effectively without me.

You always want to list when you are on an upswing growth trend as opposed to on a decline.”

One of the key financial metrics is the owner’s discretionary cash flow (ODCF), a financial metric used to assess a cleaning company’s financial performance and profitability. ODCF represents the net income of the business, adjusted by adding back expenses that benefit the owner personally. These expenses may include the owner’s salary, health insurance, personal vehicle expenses, and other discretionary expenses.

Operational efficiency also plays a pivotal role. Buyers prefer companies that have streamlined processes and established systems in place. This includes everything from booking and scheduling to quality control and customer relations. A company with these systems is considered more scalable and less risky, increasing its value.

Your company’s reputation and customer base are also essential. A cleaning company with a loyal customer base, low employee and customer churn rate, positive online reviews, and an excellent reputation can demand a higher price. In contrast, a company with high customer and or employee turnover or poor reviews may be less attractive.

💡Expert Insight: “One attractive advantage that helped me sell was that I was able to provide my buyers with a list of clients who had been with us for 5, 6, 9, and 14 years. I also provided them with a list of all staff and their positions within the company and how long they had been with us. We were able to demonstrate low turnover rates for both clients and staff. “

Industry trends and market conditions also impact a company’s worth. If there’s a high demand for cleaning companies, you might be able to secure a higher sale price.

This is also based on not only local markets but also national markets. If there aren’t a whole lot of cleaning companies up for sale, and the demand is great, you maybe be able to sell quicker and for more profits.

Preparing Your Cleaning Company for Sale

💡Expert Insight: “Preparing your cleaning company for sale starts on day one! Realize from the onset that your potential buyer is a stakeholder in your company today. A strategy I often used was that I made decisions in my company as if one day, a buyer would be evaluating my decisions. — Bad decision? How would a potential buyer feel about this? — It helped keep me accountable to someone other than myself.”

Once you understand your company’s value, the next step is to prepare for sale. Here are some steps you can take to maximize your business’s appeal:

Organize Financial Records: Ensure your financial records are accurate and up-to-date. Financial statements should be organized and easy to understand, highlighting profitability, revenue growth, and ODCF.

💡Expert Insight: “Financial records not only include accounting files, but they also include federal income taxes. If you pay sales tax, you should also collect a “sales tax clearance” that states that you are current and up to date on sales tax payment. You may also be asked to show that your worker’s compensation account is up to date.

Gathering your rent agreement is actually hugely important and can sometimes cause a sale to go south. Make sure your building’s rent is up to date. Talk with your building’s landlord to make sure they are willing to lease out the building to the next buyer.

They may also ask to see unemployment records. Making these documents available to your buyer tells a story about your business and its trends. While no given one factor can affect a buyer’s decision, as a whole, documents, and trends tell an important story about your business.”

Establish Operational Systems: Document your operational procedures and demonstrate how they enhance efficiency. This could include training manuals for cleaning procedures, customer service protocols, or your scheduling system.

Maintain a Healthy Workforce: Buyers will evaluate your team’s stability, skill level, and turnover rate. A professional, well-trained team with low turnover rates adds value to your business.

Enhance Reputation: Focus on improving online reviews and resolving any customer complaints. An excellent reputation can significantly increase your business’s value.

Develop a Transition Plan: You should create a plan for handing over the business smoothly. This includes preparing necessary documents and outlining your role (if any) after the sale.

💡Expert Insight: “You’ll need to provide the new buyer will log in credentials to certain vendors such as website hosting / cpanels, software, vendors, etc, so that they can remove your payment details for their own.”

Attracting Buyers and Mastering the Sales Process for Your Cleaning Company

Drawing potential buyers to your cleaning company is not a mere matter of luck but a product of strategic marketing and a detailed understanding of your business’s value. It’s akin to setting the stage for a compelling play, where the main actor — your cleaning company — has a captivating role that draws an eager audience — your potential buyers.

Begin this process by choosing the right platforms for advertising your business for sale. These platforms could range from industry-specific websites, where potential buyers are likely to understand your business’s intricacies, to more general business-for-sale websites that draw a diverse pool of potential investors. Approaching other cleaning companies directly can also be a sound strategy, as these businesses often seek opportunities for expansion or consolidation.

Understanding the prospective buyers for your cleaning company can drastically influence the sales process. For instance, selling to another cleaning company can be beneficial as they already comprehend the industry’s dynamics and may even have resources to drive growth post-purchase. On the other hand, entrepreneurs outside the cleaning industry can also be attractive buyers, bringing fresh perspectives, innovative strategies, and additional resources to the business.

Navigating the Sales Process of Your Cleaning Company

Navigating the sales process for your cleaning company involves several well-defined steps, each playing a critical role in achieving a successful transaction. Let’s dive into these steps and some additional insights that can make a difference:

- Deciding to Sell and Timing: The first step is determining the right time to sell, which should factor in your company’s financial performance, prevailing market conditions, and your personal readiness to exit the business.

- Setting an Asking Price: Establishing an attractive yet fair price for your cleaning company can be complex. This step involves assessing the business’s value, studying industry trends, and potentially seeking advice from a professional business broker.

- Listing the Business for Sale: Once you’ve decided on the asking price, it’s time to advertise your business on relevant platforms. This can be vital to attract potential buyers and build interest in your cleaning company. (More on this in just a minute!)

💡Expert Insight: “All potential buyers should sign an NDA. This is a crucial step that should be mentioned. Also worth a mention (maybe?) is that typically, a seller will not announce to their customers or staff that the business is up for sale as this could cause a mass exodus or spread panic and fear, causing people to jump ship to look for other alternatives.” - Negotiating and Accepting an Offer: Review all received offers critically, negotiate terms, and select the most beneficial offer. This stage also entails a due diligence process where the prospective buyer verifies the information you’ve provided about your business.

💡Expert Insight: “Follow your gut instinct on buyers. We had a few offers exactly what we asked for, but we didn’t think they were the right buyers for our staff or clients.” - Closing the Sale: After settling on terms and signing a purchase agreement, there might be legal considerations to settle. Following these, you’ll be ready to finalize the transaction.

It’s important to note that selling a cleaning company isn’t always a swift process. It can take anywhere from 6 months to a few years, depending largely on company size, market conditions, and the effort put into finding the right buyer. By understanding and carefully navigating these stages, you increase your chances of a successful sale and ensure the continued success of your cleaning company under new ownership.

💡Expert Insight: “On the flip side, like in my case, from going to market to keys handed over, the entire process was a head-spinning three weeks. It was blindsiding because I figured I would have at least a year to set myself up for life after the sale. That was not the case at all.”

Platforms to Post Your Business for Sale

- 1. Industry-Specific Websites: There are numerous websites that specialize in listing cleaning businesses for sale. Websites like BizBuySell are designed specifically to connect sellers and buyers within the cleaning industry. These websites usually have a database of interested buyers, so listing your cleaning company here can be beneficial.

- General Business-For-Sale Websites: These platforms cater to a broad array of industries and business types. Websites such as BizBuySell, BusinessesForSale, and BizQuest have extensive reach and attract a diverse audience of potential buyers. They allow you to list your business alongside a wide range of other businesses, increasing the visibility of your listing to potential buyers who may be interested in different types of investments.

- Brokerage Services: Engaging a business broker can be beneficial, particularly if you’re new to selling a business or if you want to maintain privacy during the sales process. Companies such as Sunbelt Business Brokers, Murphy Business, or Transworld Business Advisors can provide personalized assistance throughout the sale process, from valuation to listing and negotiating the sale.

💡Expert Insight: “Brokers can be costly and come with hefty fees for breaking contracts, so evaluating each one’s terms and conditions is important. On the other hand, they make their money by how much you sell your business for, so they are motivated to get you top dollar for your business, and a great broker will be right alongside you, making sure that your POV is clearly defined and communicated to the potential buyer.” - Social Media and Networking Platforms: Social media channels like LinkedIn and Facebook have groups and pages dedicated to business sales and acquisitions. LinkedIn’s broad professional network can also be a great place to let connections know about your intentions discretely. It’s not uncommon to find entrepreneurs and investors looking for new opportunities on these platforms.

- Local Business Networks: Don’t overlook the power of local business networks, local chambers of commerce, and industry-specific associations. These groups often have forums or newsletters where you can list your business.

Remember to present your business well, showcasing its strengths and potential for growth. A comprehensive, well-written listing with strong financial documentation can significantly increase the chances of attracting the right buyer.

Common Mistakes to Avoid and Legal Considerations

Common mistakes to avoid include overvaluing your business, not properly preparing for sale, and failing to secure confidentiality agreements. It’s also crucial not to neglect your business during the sale process; continue providing excellent service to maintain value.

Legal considerations when selling include ensuring compliance with laws and regulations, verifying the legality of the purchase agreement, and potentially dealing with contractual issues such as non-compete clauses. It’s advisable to work with an experienced lawyer during the sale process.

Wrapping Up

Valuing and selling your cleaning company involves careful preparation, understanding market trends, and navigating the sales process effectively. By taking these steps, you can maximize the value of your cleaning company and secure a successful sale. Whether you’re retiring or looking to explore new opportunities, a well-planned sale process can help you achieve your goals while ensuring the business’s continued success.

Your next step

If you found this article helpful for your maid service, you may also like:

- How One Cleaning Tech Employee Becomes Irreplaceable

- What I Wish I Had in Place *Before* My First Nightmare Client

- The Divorced, Broke, and Fearless Journey to Six-Figure Vacation Rental Success

- How a 20-Year Cleaning Business *Drastically* Increased Revenue by Ditching Pen and Paper

- 8 Website Mistakes That Are Costing You Leads (And How to Fix Them Fast)

Make sure you’re on our email list to find out how to get free tickets to the next event.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.