The following article is based on a presentation given by Denai Wolfe at the 2021 Maid Summit, hosted and organized by ZenMaid.

Denai Wolfe is a survivor of entrepreneurial poverty and a former financial hot mess. Learning the money side of business changed her life. Today, Denai helps other self-proclaimed financial hot messes take control of their business finances to experience transformation. She also helps successful entrepreneurs increase their profits by designing and implementing financial structures and systems through her business, the Chic CFO.

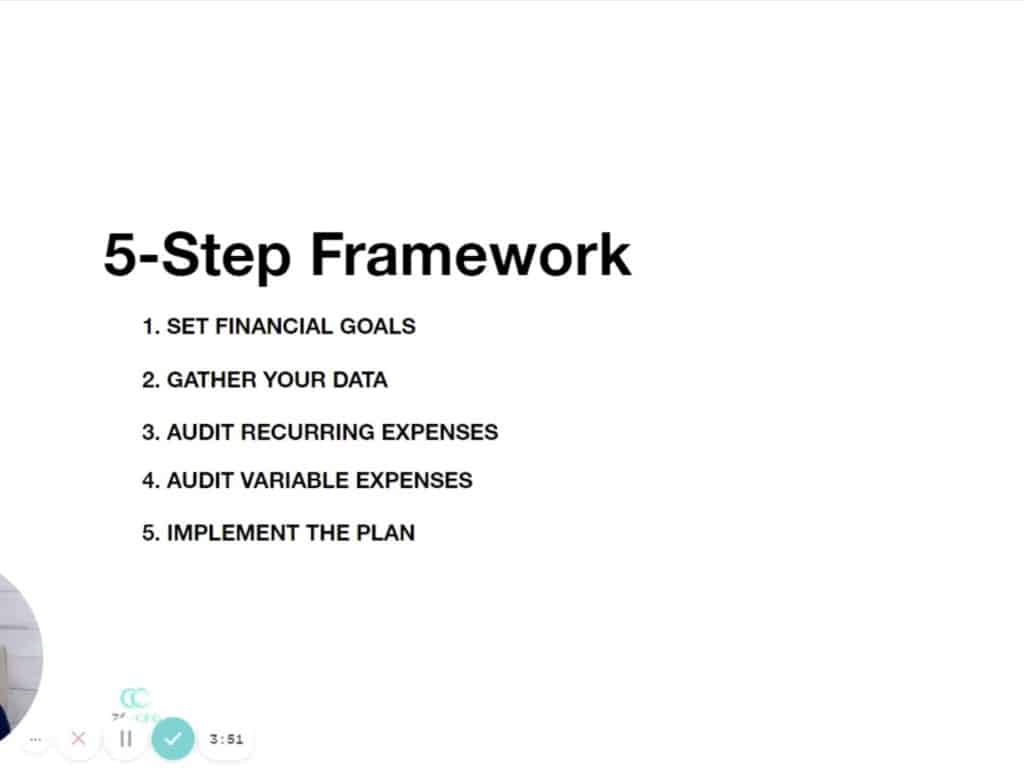

Five-step framework to increase your profits

Today we’re talking about the five-step framework to increase your profits without increasing your sales and chasing down more customers. By profit, we mean the money that goes into your pocket for you and your family.

So how can you increase your profits without increasing sales in your maid service? It all comes down to how you plan and manage your money. If you take the time to create an intentional plan for financial success, you’ll increase your profits as a result of saving money from unnecessary spending.

The five-step framework includes:

- Setting your financial goals

- Gathering the data

- Auditing recurring expenses

- Auditing variable expenses

- Implementing your plan

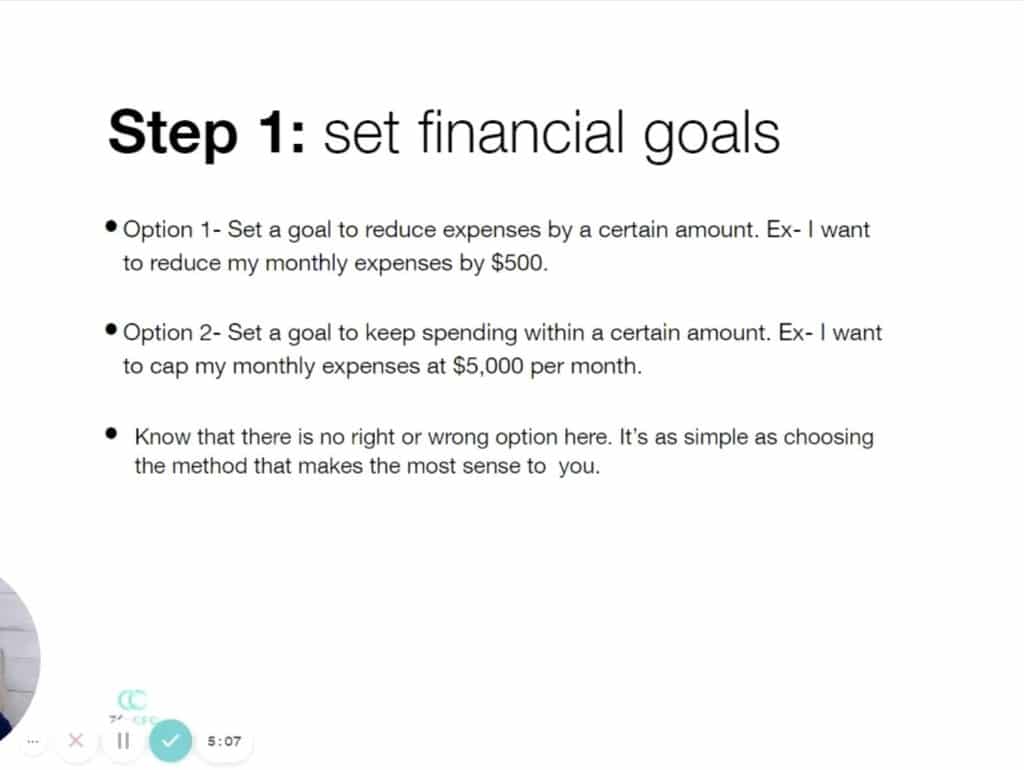

Step one: Setting Financial Goals

You have two options when it comes to setting financial goals. Option one is to set a goal to reduce your expenses by a certain number. For example, you might say, “I want to reduce my monthly expenses by $500.” Option two is setting a goal to keep your spending within a certain amount. So perhaps you’ll set a goal of capping my monthly expenses at $5,000 a month.

Here’s what you need to know: there’s no right or wrong answer. Whether you go with option one or two depends on which one resonates the most with you.

The numbers side of your business can get really noisy. It can get intimidating and scary, so we get frustrated or overwhelmed. That’s why we’ve found the best way to find success managing your money is to keep it simple. So when choosing which option to go with, respect the way your brain works and keep it simple.

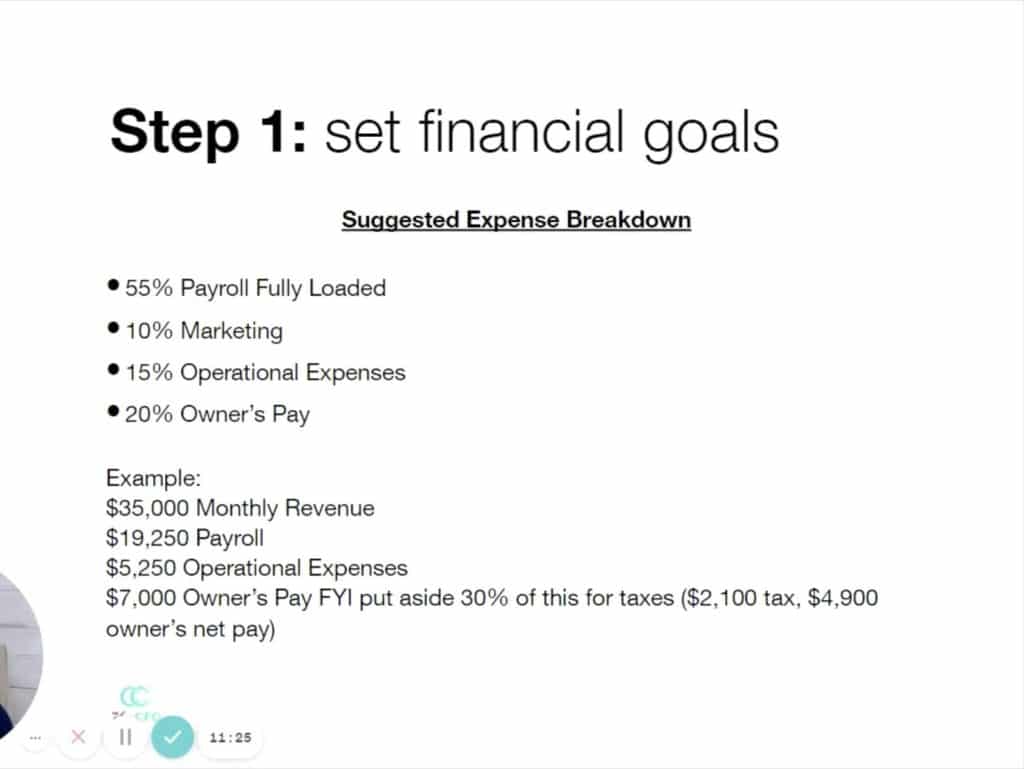

Suggested expense breakdown

The most successful cleaning businesses allocate every dollar in their budget. Using an expense breakdown as a guide map, compare this to the way you’ve been spending in your cleaning business:

- 55% goes to all cleaning supplies and payroll (cost of goods sold)

- 10% goes to all marketing efforts

- 15% goes to operation expenses, including any operational staff

- 20% goes to owners pay, or in other words, the profit you pay yourself with

So if you’ve got an average of $35,000 in monthly revenue, $19,250 should go to paying your cleaners, payroll, and cleaning supplies; anything you need to service the properties you clean. Then, you’re going to have $5,250 for operational expenses like rent, utilities, operations manager, virtual assistant, and any software subscriptions you pay for that’s going into your operational expenses.

That’s going to leave you with a $7,000 profit, which is the owner’s compensation you pay yourself with. (Be sure to set aside the appropriate amount for taxes advised by your accountant.)

Step two: Gathering your data

Step two is to gather three months’ worth of your financial data. So we’re talking bank statements, credit card statements, receipts, invoices – anything that has to do with your business. Gather your data and organize it in one place for easy reference. We suggest three months so that you can get an accurate picture and prediction of typical quarterly spending.

Now, if you’re currently commingling funds, it’s time to change that. You’ll save yourself a lot of time and headache by making a separate bank account for your business.

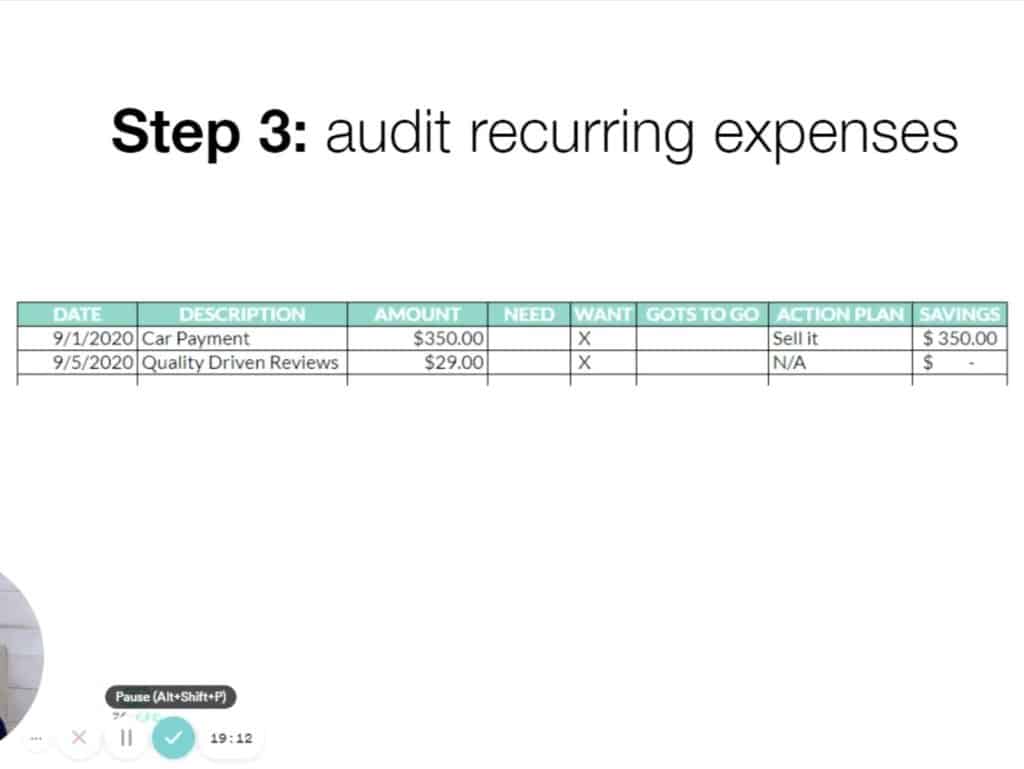

Step three: Auditing your recurring expenses

With three months’ worth of data organized in one place, audit your recurring expenses. Your recurring expenses are the ones you pay on a regular basis, for instance, your subscriptions, memberships, software, services, etc.

Then, categorize your recurring expenses into a list of three options: expenses you need, expenses you want, or expenses that need to go. We recommend recording this list in a simple spreadsheet. Once you have them laid out in front of you, determine a course of action for all of these recurring expenses.

Though this is a pretty simple step, it’s easy to let it slip down your list of priorities as a busy business owner. But you need to resist that temptation and make time for it. You’ll find yourself surprised with the amount of money you’re wasting on expenses you forgot about and no longer need. Performing this simple audit (and taking action accordingly) can save you thousands of dollars on accumulated expenses.

If you need some extra guidance on categorizing your expenses, check out this article: Six ways to improve your financial systems.

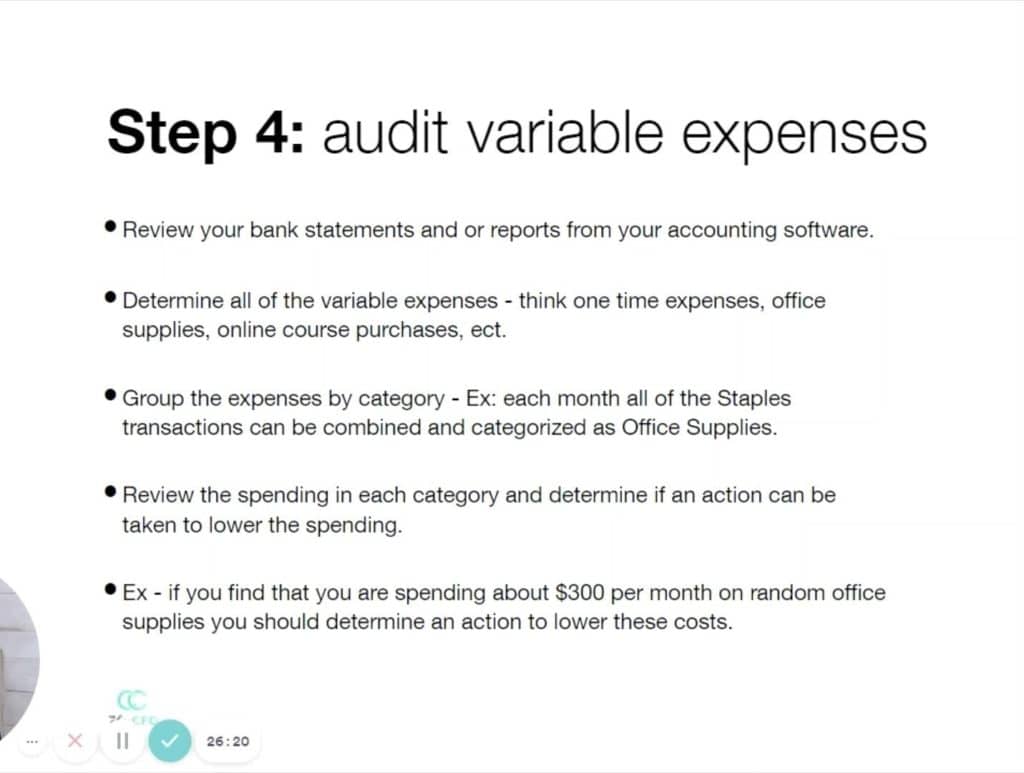

Step four: Auditing variable expenses

After you’ve looked at all of your recurring expenses, it’s time to look at your variable expenses. Variable expenses are one-off expenses that change every month, like office supplies, training or education, updating software, etc.

Similar to your audit of recurring expenses, take a spreadsheet and categorize your variable expenses into the categories applicable to your unique business.

Make an intentional budget

It’s really important to track down your variable expenses to identify if your company has spending patterns that need to be cleaned up. So when you’re looking through your bank statements, look for patterns that jump out to you.

If those items are necessary for your business, factor similar spending into your next budget. However, if you notice a pattern of excessive spending, it’s time to be mindful and make some cuts.

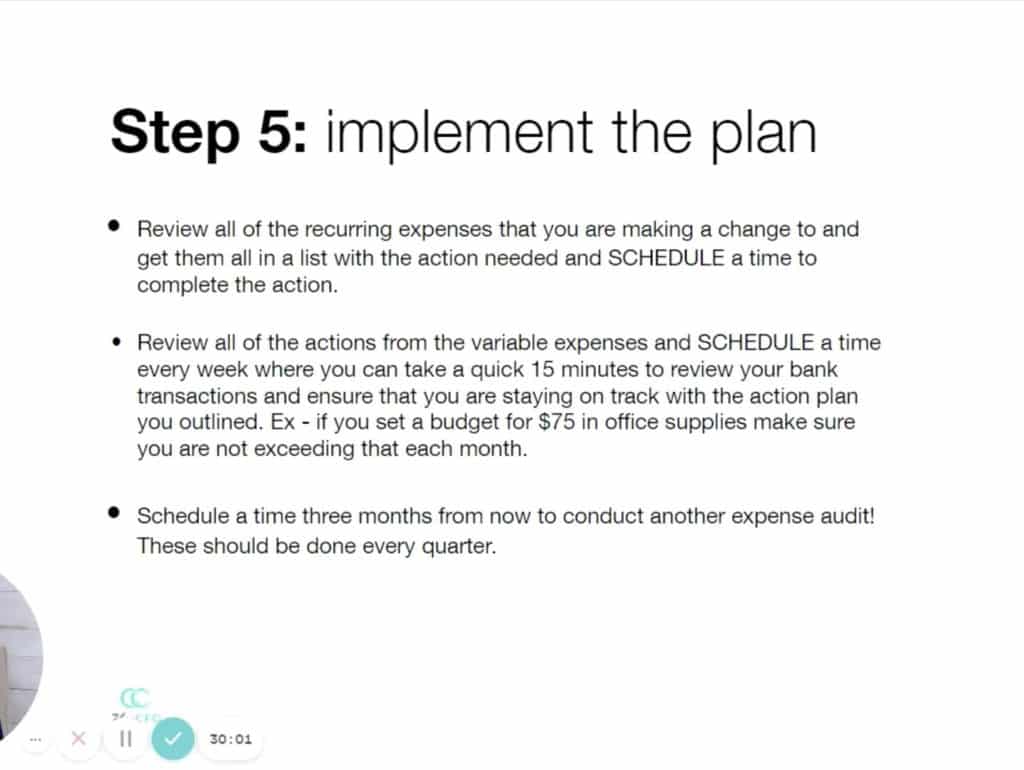

Step five: Implement your plan

After you’ve completed the first four steps, it’s time for implementation! After all, if you don’t take the time to implement what you’ve learned from your data, it’ll be a huge waste of your time (and loss of money.)

So based on three months’ worth of data and auditing your recurring and variable expenses, make a realistic budget for your business. We suggest following a similar expense breakdown listed in step one or a breakdown similar to it. Let the breakdown be your guide map of a realistic budget used in the cleaning business industry.

To help hold you accountable for taking action, schedule time to implement and review your expenses regularly. This doesn’t have to mean a huge time commitment every week (we know you’re already busy!) It can be a simple weekly fifteen-minute money meeting to ensure you’re still headed in the right direction.

It also may be helpful to give a copy of your plan to your accountant so they help hold you accountable. If you need help managing your time with financial planning, read more at, How maid services can manage their books in under one hour per month.

To wrap up

The harsh reality of financial planning is that almost every business owner gets started on the steps, but very few follow through to implementation. If you can hold yourself accountable to follow through and implement a plan based on your data, you’ll experience increased profits in your business without making more sales. No matter how busy your weeks are, that’s worth your time!

We hope you’ve found these five steps helpful and would love to hear how you get on. Leave a comment below to let us know how it goes!

If you found this article helpful for your maid service, you may also like:

How To Improve Your Maid Service’s Cash Flow By Selling Gift Cards

6 Ways to Improve the Financial Systems Within Your Maid Service

How Maid Services Can Manage Their Books in Under 1 Hour Per Month

For more resources on how to grow and perfect your cleaning business, check out the replays from the 2021 Maid Summit, hosted by ZenMaid. The summit featured more than 60 presentations from other maid service owners who shared tools and strategies to help you achieve the highest levels of success in your business.

Try ZenMaid for free!

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.