Brought to you by expert maid service owners

Listen on: Apple Podcasts, Spotify or YouTube

Introduction

Hello everyone, welcome or welcome back to the Filthy Ridge Cleaners podcast. I am your host Stephanie from Serene Clean and I hope you guys are having a lovely time. Whatever you’re doing, whether you’re cleaning right now, you’re driving to a job, you’re cooking, whatever you are doing, thank you for having me along while you do said things for your cleaning business.

And today’s solo episode is actually one I cannot believe I haven’t made yet, honestly. It is a request from my buddy Chelsea over in the ZenMaid Mastermind. Thank you so much, Chelsea, for bringing it to my attention that I have not talked about KPIs hardly at all in the entirety of this podcast, which is so shocking to me. I’m like, how have I not discussed this? By the way, if you’re not a member of the ZenMaid Mastermind, completely free. You don’t have to be a ZenMaid customer. Go join it on Facebook. It is a wonderful place with tons of community. We ask lots of advice and share funny stories. It’s a great place to be. So go on and join that right now.

Table of contents

- Introduction

- What Are KPIs and Why They Matter

- The Security Blanket of Data

- Overcoming the Numbers Fear

- How Data Soothes Business Anxiety

- The Foundation of Business Success

- Creating Reward Systems for Financial Tasks

- Streamlining Payment Methods

- Payment Processing Considerations

- Separate Business Accounts

- Weekly Profit and Loss Tracking

- The Importance of Proper Bookkeeping

- Payroll Percentage of Revenue

- Tool and Supply Spend Trends

- A Case Study: Disposable Toilet Wand Heads

- Outstanding Client Balances

- Bank Account Balances

- Hourly Rate Analysis by Client

- Revenue Breakdown by Service Type

- Additional KPI Considerations

- Cleaning Frequency Mix Analysis

- Cleaner Utilization Rate

- Getting Started with KPI Tracking

What Are KPIs and Why They Matter

The thing is about KPIs. If you don’t know what that is, KPI is a key performance indicator, which is basically just tracking metrics in our businesses. And when it comes to KPI tracking, I honestly can say that this is one of the number one reasons that Serene Clean has been successful over the years is because I have always done at least some basic tracking and it has gotten more advanced or more in depth over the years. But from the beginning, I knew how important it was to be tracking your numbers.

And so once I really started getting deeper into this, it showed me so much opportunity for improvement of the business or potential blind spots. And I use the word blind very intentionally here because I think that if you are not tracking KPIs in your cleaning business, you are going in blind. You do not know what’s actually going on.

The Security Blanket of Data

For me, I always say that ZenMaid is my security blanket. It has been from day one, meaning I know that the schedule is set. I know that it’s accurate. I also, when I was in the field cleaning still, I had the ZenMaid app on my phone and I was able to see my cleaners clocking in at the other jobs. So I’m like, okay, at least I know GPS tracking, they are where they’re supposed to be. So that was my security blanket, one of them. My other security blanket was KPI tracking.

The spreadsheets soothe my soul because it’s data. I know what’s going on and it really shines a spotlight on things that you may not be aware is happening or it eradicates us going off of feelings. And I am very much in touch with my feminine energy and feeling and enjoying and all of that stuff. But I will say that there is something very powerful about tracking and knowing the data and removing all emotion out of what is, right? Because when we can just see what is and we know, then we can make solutions off of that or change our behavior based on what is actually going on in the business.

Overcoming the Numbers Fear

When it comes to what things to track, I know how overwhelming it can get. And a lot of you guys are self-proclaimed, not numbers people, or the sight of a spreadsheet makes you break out in hives. And I can totally understand that. I’m definitely one who’s always enjoyed a budget. I’ve always enjoyed crunching the numbers and nerding out on spreadsheets. That’s just kind of my personality. And I know that that’s not everyone. A lot of people get very overwhelmed or confused when they start digging into stuff and then just throw your hands up and you’re like, I don’t want to do this anymore. Let me just get in the field and clean, right? Because at least that is something that feels very tangible that we could be doing, right?

Or let’s go do quality checks or whatever it is that we need to do, sales calls, which those are all things that have KPIs related to them. However, if we are not tracking the financial side of things in a variety of ways, we just don’t know what’s going on in our business and we cannot make educated decisions because we don’t know what’s going on.

How Data Soothes Business Anxiety

I can’t tell you how many times I have felt stressed or overwhelmed until I started digging into the numbers. And then I’m like, this is why this is happening or whatever. And it might not change that something shitty is happening, right? Maybe lots of cancellations or whatever the situation is, or for us right now, we’re having sickening turnover and we’re super short staffed. And so that directly correlates with revenue, but I can see exactly why and where, and it makes it make sense to me. And it really, it just kind of soothes my anxiety of not knowing.

All of that being said, there are so many areas of tracking that we could talk about. And I definitely know that Chelsea has brought this to my attention. We will have some episodes about tracking in different areas of the business. But I really want to start with tracking in a financial sense first. I think that that is the nitty gritty, the most important thing because at the end of the day, we’re running businesses, and we need to make sure that it financially is in a good, healthy place, it’s feasible, and we are charging enough, we’re not spending too much in certain areas.

The Foundation of Business Success

I know that a lot of you open businesses because you’re great cleaners, right? Or you want to make a difference. But if we can’t be solid in the actual managing of the financials, none of this matters. And I’ve always described, when I started the business, one of my kind of secret weapons was I already was an office manager at my parents company. And so the reason that’s a secret weapon is I learned how to book keep. I learned how to pay the invoices and all of the really boring, as they say, not sexy stuff. You know what’s sexy is marketing and branding and picking out your colors and doing great before and afters. That’s all the sexy satisfying stuff. And it’s really boring to do all of the things that I’m about to describe to you.

But what I find most useful for me to get motivated to do these things is I just tie it to kind of a little dopamine hit. For example, before I get into the KPI tracking and stuff, I mentioned many times I follow the profit first method of money management in my business. So if you haven’t read Profit First, I highly recommend, it’s just a really simple way to manage the business finances and really more so the cash flow and so that you are not spending money that technically should not be spent on one thing when it’s allocated for another thing.

Creating Reward Systems for Financial Tasks

For us, this means we have multiple bank accounts, and I do allocations from the one bank account into the others once a week. And so in Profit First, Mike, the author, he suggests that you can get to maybe twice a month or once a month, depending. I personally choose to do the bank transfers every single week because it is a, for some reason, it makes me feel something good when I transfer the money and I see the money in the accounts. And maybe it’s because one of those accounts is owner’s pay. So I’m literally transferring the money over to be allocated for my paycheck. And so that feels good. I don’t know. It’s just now I’ve wired my brain now for years of every single week on Tuesdays, I do this financial stuff and it’s just now a habit.

But some of these other deep dive KPI tracking, I don’t do on a regular basis as much. It’s more so on a monthly thing, or if I’ve got a wild hair and I’m deep diving, because I’m feeling anxious. And so honestly, it’s weird now that I’m kind of verbalizing this, I use KPI tracking as a way to soothe the anxiety of business ownership, honestly, because it’s something about knowing the information or diving into it and feeling I understand what’s going on in my business. It just gives me, and a lot of times I’ll totally start tracking something and I’m like, I don’t really know why this is helpful, but it makes me feel good. So there’s that aspect too.

And I know for you guys, you do not have time for that type of stuff, right? We’re trying to get to the bottom of what do you right now need to be tracking in your business. So first and foremost, profit first and anything that you can do to tie a reward system for you doing these things, do it. Maybe every time you do your financial tracking, you go get your favorite ice cream after, right? And that’s the only time you can get that ice cream or whatever that thing is or watch your favorite trashy TV show. You can only do it after you do this thing. So that’s kind of rewarding the little mouse in your brain. Power of Habit, it’s a great book on that. And Atomic Habits by James Clear is another great book on habits. So what we’re talking about is building the habit of tracking.

Streamlining Payment Methods

This is something I see in a lot of newer companies for cleaning specifically is I meet with them, right? We do a consulting call and I’m like, okay, let’s talk profit and loss, right? How much, what’s the monthly revenue? What are you spending? What’s leftover, right? And they can’t tell me that because they are accepting money from all over the place. And meaning all of these different cash apps and check and regular cash, and maybe a Stripe or Square or QuickBooks or something like that. And none of these things are inherently wrong. What’s wrong is you cannot tell me how much money you’re bringing in, right? Because it’s all over the place.

So I would highly suggest number one, streamlining the ways that you accept money because it gets very overwhelming to do it this way or integrate whatever your bookkeeping software is or how you keep track of your money, if you don’t have one right now, I would definitely suggest QuickBooks is a great one. There’s also Xero, Wave I know is very popular. And then just in general, Stripe and Square have some excellent tracking for this type of thing. It just probably is a little bit more limited on how you can accept money because those are payment processors. So they’re more likely to not accept a bunch of different ways of payment. Keep that in mind. A lot of times you’re going to have to integrate different softwares.

And I know that again, that this might feel overwhelming, but right now it’s probably a mess for you. If you can’t tell me how much money did we bring in last week, in total, not just in one way of accepting money, but in total to the business. So for us, we do all of that through QuickBooks Online.

Payment Processing Considerations

And again, I’m a big fan of Stripe and Square. I think that those are great too. And then you can accept credit card payment. You can accept bank transfer, which is very common. But we don’t accept Zelle. We don’t accept Cash App or Venmo. If they pay, I mean, I guess they could pay in cash. That’s very unlikely, but they’re not allowed to leave the payment for the cleaner because I don’t want my cleaners handling the money either. They can pay with check. Also just less common, maybe older folks would do that or commercial accounts, but by far and above everybody’s paying with bank transfer or a card, right? And so that just makes it a lot easier and simpler.

So the first step is going to be limiting, reducing or streamlining the ways you accept payment so that we can have a solid grasp on how much money is coming in. And obviously ZenMaid has a great invoicing system as well and it integrates with Stripe and Square and I think one other payment processor. For Serene Clean, the reason why we’re not doing that, it just takes us a while to switch processes. When it comes to something as large as that, we got really burned on a payment processor that we tried. I will name and shame, it’s called Stax. So we switched to Stax, S-T-A-X from QuickBooks Online, because it had cheaper payment processing, credit card processing. And we realized quickly why it was cheaper because the horrific customer service, constant errors, our customers were getting pissed. We were terrified that mistakes were getting made, not on our end, but just from the actual software itself.

So when it comes to you guys not wanting to pay payment credit card processing fees, this is where that’s a cost of doing business. And if you are going to be charging business rates, you need to be accepting the fact that that is a fee. And so we do not tack that on as a separate thing to our client’s bill or anything like that. We just increased our rates to basically swallow that up. I think we pay $20,000 in credit card processing fees every single year.

Keep that in mind, that scales of course with the size of your business and we just accept it. That’s not something that is ever going to go away. Again, three to 3.5% is very standard for the industry. So don’t balk at that and just, you’re not getting around it basically. If you’re going to accept your clients paying with credit card, which again, if you’re a business and not an individual cleaner and you’re trying to set yourself up as a business, well, businesses accept credit card payments, all right? So we need to make it convenient for our clients to pay and that is one way to do it. And then you can have card on file, which is great, of course.

So that is one of those things you’re just going to have to eat the cost. I know you can do cash discounts, this is the fee and then, if you pay in cash, the fee is gone. There is some legality issues with that. I know in some states, so if you’re going to do that, ask chat GPT first, hey, I’m thinking of doing a cash discount if somebody pays in cash or a check, obviously, is what we mean as well, instead of a credit card, is this legal in my state? Because sometimes it’s not. So do be careful there.

Separate Business Accounts

So first and foremost, let’s corral and figure, get all of our income and revenue consolidated. And it goes without saying, separate bank accounts, guys, separate bank accounts. Do not have this all going into your personal account. You should have a business account. I know some of you are rolling your eyes right now. I talked to many of you and you don’t have this yet. Okay, so this should be absolutely a goal. And then when you pay yourself as an owner’s draw, you can either write yourself a check or you can transfer and record that transfer in your bookkeeping software as an owner’s pay, but we do not want to be paying for our personal expenses out of our business checking account, okay? So that’s first and foremost as well.

Weekly Profit and Loss Tracking

So now that we’ve wrangled and we’ve figured out how much money are we making every week or how much money are we bringing in, not profiting, but gross revenue, right? How much is coming in? Now we need to figure out how much are we profitable every single week or every day, every month, right? So I track this on a weekly and then a monthly basis. So every single Tuesday, it’s my financial tracking day. So what I do is I run a profit and loss report in QuickBooks and that way I can see how much did we make last week? How much are we making this month? And see where we’re at. And I will also compare it to the previous month and previous same month of last year to see where we’re at in comparing apples to apples.

So that is a very useful thing to do as well is comparing to see are we on track and why are we or are we not, right? And so what I have is I have a financial tracking spreadsheet and that’s just in Google Drive. And so every single week what I do is I run this P and L and then I have just a row for that’s that week’s date. I do the revenue for the week. I add that to the total revenue for the year. And then the next column is going to be expenses for the week and then running expenses for the year and then profit that week, running profit for the year. That’s literally, I do that every single week. I’ve done it for years.

And again, you can just run a report in QuickBooks and see this. But for me, I have it in a spreadsheet so I can have complete control over how I use that data. And it’s not just dependent on whatever your bookkeeping software’s limitations are on reporting and again, I find unless you’re running that report, you’re not really thinking about it. So that’s very helpful to have that data all in one place and it can go from for years back that way so that would be one of the first things I would suggest starting and that is all caveated on you doing proper bookkeeping.

The Importance of Proper Bookkeeping

And what I mean by that is tracking your expenses and categorizing them based on what type of expense it is, right? So that you can clearly see every single month what you’re spending money on in the business. And again, this is where a bookkeeper can help, an accountant can help. I do really think that you should have basic knowledge of bookkeeping though, if you’re going to run a small business. And that comes down to protecting yourself and never getting bamboozled by a bad person. And that is where embezzling happens.

I feel like I’m saying potentially a Dr. Seuss rhyme right now, getting embezzled by a bamboozling bad banana. I don’t know. It’s still early in the morning guys, okay? The silliness, the caffeine hasn’t hit. I’m still working on my Celsius here. Okay. Also Celsius, will you sponsor this? Cause I drink you every day. So that would be cool.

So we need to be bookkeeping. We need to be tracking our expenses. And again, if you don’t know how to do that, there’s so many great apps for that QuickBooks. You can literally just take a picture of their receipt and add it. We literally connect our business bank account to the QuickBooks. And so it brings in all of our expenses and we just have to confirm or match them. It just makes it really, really easy to do the bookkeeping as well as our payroll software, Gusto. It integrates with QuickBooks so we can just make it, every time we run payroll, it creates a payroll journal in it. So it’s very nice.

And again, I know that this might seem like a lot, actually is not super complicated, especially in the beginning, you don’t have that many crazy expenses or you shouldn’t, right? So, it was very simple for me to do this in the beginning. Now it’s a lot more robust at the size that we are now, but for you, just keep tracking your receipts, make sure that you are tracking all of your expenses. It’s very simple. And there are so many great resources out there for free to teach you how to do this, basic bookkeeping on YouTube, right? Or again. Chat GPT is your best friend of hey, I’m just starting out. How do I do this? Right?

So that would be, again, all of these things are kind of background of these things have to be in place for us to even talk about KPI tracking. Right? So just doing these things correctly is a big win. All right. So if you are doing those right now, give yourself a pat on the back right now, because that is far and above a lot of small businesses where they’re not doing proper bookkeeping. And if you are not doing this properly right now, this is not a shaming moment at all. This is a goal. We need to get this in place before we can talk about anything else. So right now, tell yourself, I am going to work on this every single week. I’m going to get a bookkeeping process in place and I’m going to track my expenses and I’m going to track my income. It’s very simple. I think we put it on this giant, this is so confusing and complex. It does not have to be, right? And that’s where having some type of accounting professional in your corner is very important as well.

Payroll Percentage of Revenue

So now that we got the weekly P &L, we’re tracking that every single week. I also track payroll percentage of revenue. And the reason we do this is because then we can see where we’re at, how much are we spending on our staff, their paychecks and everything related to staffing. So that’s also going to be, when I say payroll expenses, that’s going to be, there’s a lot of things that go into that. It’s not just how much are they making per hour, right? There’s a lot of other costs potentially, gas and mileage stipends, taxes, all of that type of stuff related to payroll that could be happening if you offer benefits. There’s a lot of costs associated with it.

But the reason we want to see where this is at is because for the industry across the board, if you have W-2 employees, they should be costing you about 40 to 45% of your revenue. And even that’s kind of pushing it. And so for me, because, that’s technicians, okay? This is where things can get complicated. If you have admin labor, right? Admin labor, is called, that is overhead, right? That is overhead. They are not physically bringing in revenue because of their labor, where cleaners are.

So for me, it gets a little bit more complicated because I separate out my management payroll expenses versus my technician payroll expenses. Because if I just look at my full payroll expenses, it can get quite confusing of shit, this is 60% of my revenue or 63% of my revenue is totally payroll expenses. And then it’s, well, my numbers are off. But for us, anywhere from 14 to 17% of that every month is going to be management expenses or costs or overhead. When it looks, so that makes sense. I have the overhead money to cover that obviously, but for you guys, it’s how much are the techs costing you compared to what you’re bringing in on that same labor hour, depending on how you pay, right?

So for us, if we’re charging, $50 to $55 an hour, all payroll expenses on that single technician, that labor hour of their time should be, $20 to $25, right? And so that dictates how much can we pay our staff, right? You may have crazy desires to pay $35 an hour to W2 employees. Most likely that cannot happen unless you are charging really, really, really high, $70 an hour, right? So, and per cleaner. Keep that in mind that that helps us stay, I guess, on earth when it comes to the reality of being able to pay our staff. So that is a good thing to see of how much are we paying out to our staff compared to the revenue that we’re bringing in.

Tool and Supply Spend Trends

One of the easy ones to do, I think, is tool and supply spend trends. So this is something that it can get a little bit tedious as well, especially if you really want to get into the weeds, which we do. So we literally track all of our spending related to inventory, both on cleaning tools, and then cleaning supplies. And April, my payroll manager, she does all of this inventory tracking and it’s great. For you guys, it may just be making sure it’s tracked in QuickBooks when you are spending on, here’s the receipt for all of these supplies or these tools, right? And seeing compared to revenue, how much are we spending on tools and supplies every single month.

And the reason why this is so important is tools and supplies should not be very much money for us, right? I know that that might sound crazy because it’s, well, shouldn’t that be more? It really shouldn’t. Historically for Serene Clean and the history of the business, tools and supplies has always been two to 3% of revenue. So, and I’m talking the entirety of the business, right? So that is actually a very low amount and we try anytime. If I were to reach 4%, I’m taking a look and seeing why, what is happening? Did we buy some type of large piece of equipment or something? But it’s just, it’s a pretty low cost business as you guys know.

But what tracking does is it shows us if anything bad is happening. And by that, I mean theft of supplies from your cleaners or probably more likely improper use of supplies and tools by your cleaning techs. And for us, that is what historically has happened the most is that cleaners have been using too much of a supply and without tracking, again, we’re going off a feeling of gosh, I feel I’m buying a lot of this, barkeeper’s friend or whatever the supply is, but by tracking it.

So for you guys, what I want you to do is just start bulk tracking. How much are we spending on tools and supplies a month? Compare that to how much money did we bring in? Is it in this range here? If not, is there something we could do to tweak or maybe use a different type of cleaning product or just really look at what’s going on here? If you want to get a little bit more advanced, you can literally track it down to each tool and supply. And this is what we do. April’s got this glorious spreadsheet that breaks down every single week. What did we order? What individual products and tools did we order? How much? How fast are we going through things? How much did it cost? So we can really break it down nitty gritty.

And I know that that’s tedious. Again, I’m just sharing what we do. I’m not suggesting that you need to do this right now, but if you’re finding gosh, this really feels out of control, this can be a great way again to see. So what we’re talking about is being able to see clearly what the heck is going on.

A Case Study: Disposable Toilet Wand Heads

So the most glaring example for us of a tool or supply being improperly used is disposable toilet wand heads. So for Serene Clean, it is a requirement that our clients have a toilet brush by every single toilet in their home. The only exception of course is going to be vacant homes where they’re not going to have toilet brushes in the house most likely. So what we have in all of our cleaners kits is going to be the, I think it’s a Lysol or Clorox, the white wand with the little blue cute pop on heads, that’s what we have them have a little pouch of and then they have the handle. If you’ve ever used those, you know those are hella expensive. They’re very expensive, but they work great. They’re disposable.

And for our cleaning staff, they are to only use them, as I said, at vacant homes. So by tracking this, we realized that our cleaners were not just using them at vacant homes, right? And this has been a reoccurring issue that we’ve had where if there’s not a toilet brush, they feel bad about not doing the toilet. So then they go and use their wands. But it literally is explicitly said to our clients, if you do not have a toilet brush in every single bathroom, we will not do the interior of the bowl. So just making sure that our clients are aware of that, which they are, and our cleaning techs are aware that they’re not going to get in trouble. If they don’t do it, they just have to clearly mark it on the checklist as to why it didn’t get done.

And the client will then go buy a $3 toilet brush at Dollar General. It’s fine, they can afford it. Clearly, they’re having a house cleaner, right? So this is very important for us to track because we realized that we were spending hundreds of dollars on this a month because we were going through them until, and so for us, people, when we run out of stuff, we would just order it, order it, right? And a lot of times that’s what happens, especially if you’re really busy and you’re still in the field, you’re just doing a quick scan. What do I need? You run to Walmart, you place an Amazon order, right? And you just don’t, it’s done then, right? You got the supplies that your team needs, it is done.

But until we start tracking trends, we don’t know how much is normal for us to go through in a month. Maybe a cleaner is stealing supplies. You know, that doesn’t, again, we haven’t really ever had that happen. I know that some of you have had that happen though. And again, you can put cameras into your supply area and see what’s going on. If you suspect that, that’s a very simple fix right there. But it could be this, right? Where they’re improperly using stuff and then you need to have discussions with your cleaning staff as to how you want the supplies and tools to be used to make it the most financially feasible for the business.

So that was a quick nip in the bud situation that we had once we discovered that of hey guys, you’re not supposed to be using it this way. And once we explained that the next month, the amount of disposable heads that we were going through dropped dramatically.

Definitely think that tools and supplies is a great place to start. And it also limits you from experimenting with a bunch of stuff all the time, because I know, especially as individual cleaners, it’s very fun to experiment with new tools and supplies. I would limit that to your kit only. All right, don’t be buying it for your whole team to try out, right? If you want to implement something, maybe you and one other cleaner can try it before you go and buy the whole team the thing, and then onto the next shiny new cleaning product, right? Keep it simple, try not to introduce a bunch of new stuff all the time because it adds up and then, coming back to compliance, you’re probably not being OSHA compliant, which means you need to have a safety data sheet of all products accessible to you and your cleaning staff at all times, whether digitally or physically.

So I bet, I would bet 12 whole dollars that you are not being OSHA compliant every time you introduce a new product. So if we can just limit that. You don’t need a super extensive kit, right? We don’t need a million different products. We can keep it pretty simple and be very effective and then just bring in the heavier duty guns when necessary and utilizing things like drills with scrub brush attachments to agitate and get soap scum off as opposed to super heavy harsh chemicals, right? So tools and supplies, spend trends, I think is a great place to start considering that is going to be one of your biggest expenses outside of payroll.

Outstanding Client Balances

Next area of tracking. This one is quite simple, guys, and it’s going to be outstanding client balances. And that’s going to be called accounts receivable in any bookkeeping software. And for a lot of you, you might be, why does that even happen? I take payment as soon as I leave the cleaning or I do not leave the cleaning until I get money. I totally understand that depending on your policies in your business will determine how much, any of outstanding balances that you have. It’s very important that we keep track of this. I literally put this again on that financial tracking sheet. That is a column is accounts receivable. How much money do people owe us?

Remember, Serene Clean is 50% commercial. there’s going to be outstanding balances, right? Because of terms. And we try to keep our terms very, very short, net 10, net 15, but still there’s going to be some money that is owed to us. And for our residential clients, it is technically due on receipt, but we give them a grace period of I think three to five days before we’re going to be asking for that payment and really hammering home. And a lot of them are card on file as well.

It’s just important that we watch how much money do people owe us and absolutely do not go and do another cleaning if somebody owes you money. Again, commercial is one thing. Residential, this is something that we have struggled with before is we have gone and done multiple cleanings and they haven’t even paid for two months ago or something like that. And so just making sure we’re really cognizant of who owes us money, how long it’s been and don’t go clean for them. Because think of it, if you went and got your hair done, didn’t pay and then tried to go back to that salon again, they’re not going to do your hair, right? So why are we cleaning for clients who have not paid, right?

Bank Account Balances

Next is going to be again, the bank account balances that’s on that same spreadsheet is I am tracking the bank account balances for all of these different accounts. So that’s going to be for us revenue, tax savings, operating expenses, business savings and owners pay. And so I have a column for each of those. And I just every single week say, what is the balance of those? And then I can kind of see the trends of what is normal? Where should I bank accounts be? And then it’s kind of fun to just to see the trends over time. It’s very inspirational, sometimes panic inducing as to why something might be lower, right? But it just, shows us the ebbs and flows of the actual money.

Hourly Rate Analysis by Client

So the next one, it can get a little complicated or just time consuming if you’ve never done this before, especially if you are charging flat rate, but this is going to be of course kind of related to production audits, but more so on the how much are you making per hour, not how fast you clean. And so I think it’s very important to know the breakdown of how much your client, how much you make per hour at every single client.

So that’s going to be on both flat rate, if you charge hourly, how many are at each hourly rate that you charge. So for us, we started way back in the day at $30 per man hour, and we’ve done price increases up to our current, which is going to be 50 or 55, depending on our close rates, we will jump between those two prices. And so I literally have a chart or a spreadsheet of the split between each of those hourly rates and how many clients are at each of them, right? And so that allows us to see what is the breakdown? What’s our average client price? And when we’re doing price increases, who do we need to do those price increases on? Cause it might not be on everybody. So that’s very useful.

And for you guys who charge flat rate for residential, it is so important that you know what is the average hourly rate at every single client. Because especially if they start adding stuff on, and you don’t do a price increase, all of a sudden that hourly rate starts to plummet because of that scope creep. And that’s why it’s so important every single time somebody asks for more services to be added onto their regular cleanings, we need to do a price increase at the same time. So that’s why for me, hourly is really simple because it’s, well, you’re paying for the time, right? So if you’re going to add more stuff on, either other things need to come off or we need to charge for more time. So that makes it a lot easier.

Commercial, that’s where it’s always going to be flat rate, at least for us, we charge flat rate at all of our commercial accounts. So doing these audits on a regular basis, whether that be quarterly or every six months, or even just a couple months into service of okay, you bid this much, are you making what you want to make hourly there? Or did you underbid? And so that is a great tool to learn. So I think it’s really important to know where all of your clients are at, on an hourly rate basis, regardless of how you charge.

because then you can apples to oranges see the breadth of pricing that you have. And obviously there’s a lot of ways to skin the cat of pricing. This is just, it kind of just allows you to standardize across the board because it’s, okay, this person’s at 120 every visit. This one’s at 240 every visit. It’s, well, that’s hard to compare. What are we making on average per hour at all of these clients? And is it in the range that we want to? So that would be a really great one.

Honestly, when I do consulting calls, that’s one of the first places we start is what are you making per hour on average at your client’s houses? And you can literally just create a spreadsheet and anybody who’s under what you want it to be, highlight it red. Those are the guys that need price increases or to reduce services, all the different levers we can pull, but that makes it clear. And you can just color grade it green, yellow, red. of the clients that absolutely you got to drop them now or you need to increase prices to even make sense. Yellow, meh, you’d like to make more but you don’t need to maybe do a price increase right now and green, great clientele, you’re making what you want to make. So that would be one of the first places I typically start to see the state of the union of a cleaning business is how much are we actually making at all of our clients, right?

And it’s just easy when you’re charging hourly because it’s already there. You’re going to have to do a little math if you are charging flat rate to make sure you are where you’re at. And also that’s where it comes into are you consistently going over on time? Because you bid this price and you thought it was going to take you four hours, but it really takes you five hours every single time or whatever. So it really just, this one shows you so much information immediately of well, this isn’t what I thought at all. Maybe we clean slower than I anticipated and I’m being unrealistic in my estimating. So that one is super duper important.

Revenue Breakdown by Service Type

Next one is going to be revenue breakdown by service type. So this might not be super relevant to those of you who just do one type of cleaning. You’re, I just do straight up residential cleaning. But what you could do, I find it very useful. So for us again, depends on how you do this, meaning your bookkeeping software.

Utilizing QuickBooks, they allow for tagging of the invoices and all of our sales. And so what we do is as we invoice, April literally tags the invoice by type of income or revenue or sale that it is, whatever you want to call it. And so for us, we track a variety of things. So it could be a first time clean of a residential home. We track that revenue separately or tag it separately.

And then all other residential revenue is tagged just residential. We also have vacation rental, we have commercial, and then we have gift cards, gift certificates, whatever you want to call it. So we tag all of our revenue in these five categories. And so that way it is very clear when something goes up or goes down in any of those, what’s actually happening. Because especially as you grow and if you do have these different services, you’re just seeing revenue, right? Or revenue by customer. But if we want to see revenue by category of type of cleaning, then it can get difficult if you’re not doing those tagging system on a invoice or sale by sale basis. And so it is one extra step for us, but it has been so helpful in order for me to see what is actually going on.

So for example, I’ll show you. So let’s look at the past two months, May 2025 and June 2025. So we were down in June in revenue from May. We were down about $5,000, four or $5,000. So, okay, that information tells me one thing, we were down, but where, how, why, who, what went there? And so because we tag our revenue, I was actually able to see what it was.

When I, let me go to my little dashboard right here. And just a second, let me see here. Okay, so I have a bar chart that says revenue split and it splits it down each section. So again, I can see that we were down from June, from May to June. But because I can see the split, I can see exactly what happened. So our first time clean revenue in May was $1,989. It was $2,670 in June. So that went up, right? We actually were able to get more first time cleans in. That’s a wonderful thing. Okay. In vacation rentals in May was $3,654. In June, it was $6,018. Again, drastically up, right? So didn’t go down there.

So we’re narrowing down. Okay, residential revenue was $45,427 in May. In June, it was 43,651. Okay, so we had a couple of grams there less, and I know because of our significant turnover, lots and lots of call-ins, I think we had 130 hours of call-ins last month. That is a reason we had to cancel on some clients. We couldn’t fit in any one off maintenance cleans or anything because we had no availability. So that right there tells me something.

Finally commercial $53,060 in May. In June, it was $49,270. There is my big jump, right? It was in commercial. So all of a sudden I know the drop was in mostly commercial, a little bit in residential, but mostly commercial. Well, why did that happen? I can tell you why. We had one commercial client cancel a car dealership that was three times a week. So now all of a sudden that’s gone. Reason they canceled is because they had somebody at their business that wanted to do the cleaning and make more money. They’ve been with us for years. They’re, yeah, we’re really happy, but they need the money. We’re going to give that job to somebody internally. I’m okay with it. I mean, I’m not okay with it canceling, but I can understand it’s nothing that we could do, right? That would change that scenario. That was one.

Number two is we had a really large commercial account that we had to drop and we canceled on them in April, but we had one last bill to send them in May. And so that income was there in May, it’s not there now in June. So those two accounts literally account for that drop there. So all of a sudden, and that was because we couldn’t hire in that area for evening work for that school. So I now understand why it’s lower. It doesn’t change the fact that it is lower, but instead of me just being why is revenue down? I don’t understand. I know, I can clearly see it.

And by the way, those numbers, we don’t include tips and down payments into those. We don’t track those on this particular thing. So those aren’t our total numbers for the month, but it gets us pretty close. And so that information all of a sudden makes it so clear what happened. And it just makes me feel a lot more confident as to what the hell is going on in my business?

And so for you, if you are just strictly residential, it may be very useful for you to track or to tag or track whatever you want to call it, a maintenance clean versus a first time clean versus a move out clean if you do a lot of move outs, because that could tell you a lot. if you’re doing, if your business is solely based on move outs and turnovers, well, that tends to have a season to it, right? And that’s usually summertime is very, very busy for that unless you just have a ton of property managers that you work with. But it can be really, really volatile when it comes to that where, obviously the preference, at least in my opinion, is to get reoccurring clients so that it’s reoccurring revenue every single month that we’re building off of. We’re not having to start from scratch, if you will, with move outs and not have that kind of consistency.

So that could be a really great way to separate things. So again, that might just not be super applicable to you right now. It’s been really helpful to us of understanding exactly where the money jumps and drops is exactly happening because we have this wider variety of types of revenue that could be coming in. So that has been really, really helpful to us as well.

Additional KPI Considerations

Some other areas that you can track, revenue per cleaner could be interesting to you. We don’t do that, but I have done, typical speeds and things of cleaners. Again, we charge hourly, so it’s pretty straightforward for us. So, but if you are charging flat rate or paying percentage or anything, that could be a useful one for you to track.

This one I started tracking in the past six months or so and that’s going to be client lifetime value. And so that is the average number of months a client stays as well as their monthly revenue, times their monthly revenue. total, client lifetime value. It’s very helpful to see how long do people stay before they cancel as well? What is the average for you? Because we’re trying to make that number as long as possible. We want them to stay and retain that client as long as possible and make as much money as we can off of them during that time.

So how much is the typical lifetime value of somebody before they cancel? And if those numbers are really, really small, well, we need to dig into why, right? So again, a lot of times it’s just shining a light on hey, an area that we need to dig deeper on of okay, people are canceling after three months, right? Why is that? Why are they not making it to that year mark? Why are they not spending more? So there’s a lot of reasons behind that potentially that we could dig into.

But the whole point is to make you aware that, your clients don’t stay very long. And that could be a consistency thing. That could be you’re giving them a bunch of different cleaners. For us, because we’re having such high turnover, some of our regular clients are getting pissed because we are switching cleaners on them so often. We can’t really do anything about it. Because it’s, trust us, we don’t want these people leaving either. We wish we didn’t have to fire this person for stealing, but we do. So, not that I would say that to a client.

But you know what I mean? So it’s, yeah, client, I would love to be able to give you the same cleaner until they die and just chain them outside your house and make them clean under your house. Not really, I don’t want that. That’s a joke for legal reasons. But sometimes turnover happens and our clients are getting disgruntled. So we’re having to do a lot more client care and quality checks to make sure everything’s up to snuff with the new people to make them comfortable and kind of settle their grumblings. there could be, again, many reasons why your client lifetime value is low. So it’s important to track that. So that’s been very helpful for us.

Well, I’ll be a little bit difficult just because, the bigger you get, the harder it is to track that with automation, depending on how you’re doing things. So that is one thing. Let’s see here, monthly reoccurring revenue that is very useful. Again, that could be the maintenance cleans of it all versus one-offs or first times. seeing how strong is our base of reoccurring. And that would be commercial as well too, as opposed to all of these other things. So we want a nice, strong, solid, hefty base of our revenue to be reoccurring because that’s the beauty of this business and why we’re all in this business, right? Because we get to build on that base.

Cleaning Frequency Mix Analysis

Another thing that can be very interesting is the cleaning frequency mix. That one is quite interesting to me actually. I haven’t looked at the one in a minute. Let me pull it here because I think that that could be quite fascinating.

So for us, this kind of correlates with number of reoccurring residential clients and things like that. But when I look at our residential clients by frequency, 24% of them are every two weeks, 35% are every four weeks, only 3.64% are weekly, and then everything else is sporadic, 34%. And then the other ones are initials, they’ve only had two cleans. know, move out cleans, those types of things.

for us, the most likely reoccurring one is going to be either sporadic. So, they call us when they need us or they want to do it just when they need it. And then most likely after that is going to be every four weeks. So ideally we want to have, the most bi-weeklies we can and the most weeklies, cause that’s more money. But the reality of the situation, most people have us every four weeks. So again, does it allow you to do anything right now? Not necessarily, but it’s interesting. I find that interesting. And again, just, feel I know my business now more of okay, a huge chunk of people have us monthly. That’s the most typical frequency at Serene Clean, which is very interesting.

Cleaner Utilization Rate

And then the final KPI that I am going to put out there for you to potentially track is going to be the cleaner utilization rate. And this is simply how much of your cleaner’s available time are you actually scheduling? And the reason that this is useful is it could showcase some issues in efficiency in your scheduling, as well as maybe you are having them drive too much or maybe things could be adjusted in the schedule to get as much bang for your buck out of that cleaner as possible.

for example, say they’re available from eight to four, but the client, their first client of the day doesn’t want them till 10 a.m. Well, most likely you can’t fit anything else in that morning. So all of a sudden we’re missing out on two hours of their eight hour day. Or maybe they’re having to drive really far in between jobs. And obviously you’re only making money off of them while they’re cleaning and it’s costing you money because you have to pay them during that drive time.

So things like that for us really being as intentional with the schedule as possible, especially if you have a large service range, we have quite a large service range with three locations. So we try to schedule as intelligently as possible and also look for opportunities of okay, they’re available for eight hours, right? Which is really more seven and a half because of drive time. They’re on a job for five and a half hours. but we really can’t fit another house in, but could we fit a small office into that day? Because all of our cleaners are hybrids and are expected, well, most of them are hybrids and expected to be able to do both residential and commercial.

And this is where I know a lot of you are commercial, it’s always at night. No, it’s not. There’s so many little offices that could be a perfect ending to your residential cleaner’s day. It gets them the full hours that they’re wanting. You’re utilizing their day to its fullest. And yeah, it’s not maybe this big giant revenue booster, but those little pockets, they really do add up. And so if we can’t add another house, what could we add? You could also a lot of times add a vacation rental turnover, but those are much more time sensitive and have to be at specific times a lot of times. So a little bit harder where a lot of those small offices that we do that are once a week, they’re highly flexible, they’re okay with us coming during the day, depending on what it is. And we can just plop that at the end or the beginning of a residential cleaner’s day to round out their day.

So you may not be aware of how many of those little pockets are existing and maybe you totally need to rearrange the schedule and pair things in a more intelligent manner. And of course I say all that with the caveat of we come in every week with the best possible plan and then three people call out. and now it’s just sheer chaos and we throw this out the window. So this is an ideal world and every single week things don’t happen ideally for us, not at all. It’s literally get these cleanings covered. We’ll say to our cleaners you’re driving further than usual. We understand that and that’s part of the job listing and the job requirement is they know what the driving could be, worst case scenario. We try to do best case scenario planning and making the most efficient use out of the schedule, especially with a large service range as I said.

That is one thing to take a look at as well as how much of your cleaner’s availability are you actually scheduling? And if there’s these types of pockets, is there some rearranging that could be done? Could you utilize teams in an intelligent manner to again, get the most bang out of the buck for the day and just, yeah, squeeze every single dollar we can out of every single day without costing you a ton in travel and everything associated with your cleaners. you know, being paid but not cleaning basically. So that could be an area to look at as well.

Getting Started with KPI Tracking

So some of these things are going to be more practical for you right now guys. Other areas might just be more an aspirational thing to track in the future. But these are some great places to start. As I said in the beginning, I would focus on the basic ones first and making sure that we are profitable, we’re making enough, we’re seeing how much each client is actually making us, how much are we charging, how much are we making per hour. who needs price increases potentially. And then we can delve into some of these other more nuanced ones as time progresses.

But honestly, if you do those first couple, you’re going to be far and above where a lot of people are. So this will give you a nice overview and a lot of anxiety soothing if you start doing some of these areas of tracking. So that’s what we are going to cover today for financial tracking. I definitely want to talk about sales and marketing tracking in another episode, but I’m starting to wilt. can feel myself babble.

So if you have made it this far guys, leave a green heart down below in the comments, cause I am wearing this lovely green zip up hoodie from, I don’t know, Under Armour, think. So leave a green heart down below guys, whether you are on Spotify, the Apple thing. I don’t listen to, I don’t have an Apple phone guys. I don’t have an iPhone. So whatever it is that you are listening to this podcast on, leave that down below. Any other content requests, definitely leave that as well. And we will see you on the next episode of Filthy Rich Cleaners, guys. Bye.

Note: This transcript has been edited for clarity and readability.

Resources Mentioned in This Episode

- ZenMaid Mastermind

- Profit First by Mike Michalowicz

- Power of Habit by Charles Duhigg

- Atomic Habits by James Clear

- QuickBooks Online

- Xero

- Wave

- Stripe

- Square

- Gusto Payroll

- ChatGPT

QUICK TIP FROM THE AUTHOR

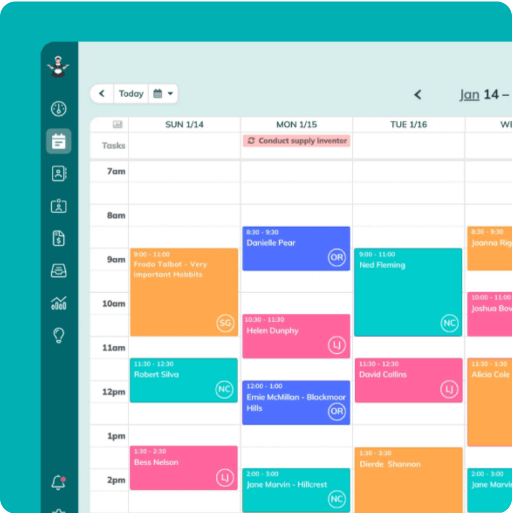

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.