Brought to you by expert maid service owners

If you’re starting a cleaning business, licensing is one of those things that sounds intimidating but usually isn’t. It’s mostly paperwork. The confusing part is figuring out which paperwork applies to you.

General search results don’t help much. One article says you need a license. Another says you don’t. A third mixes licensing, insurance, and bonding into one big mess.

So this guide is here to clear that up.

We’ll walk through how licensing works for cleaning businesses in plain language. What’s required, what’s commonly misunderstood, and how to get yourself set up without overthinking it.

Here’s how to license a cleaning business in 2026, step by step, without getting lost in paperwork.

Quick note: Licensing rules can vary by state, city, and even county. This guide covers the most common requirements for cleaning businesses, but it’s not legal advice. If you’re unsure about anything specific to your location, it’s worth double-checking with a local small business office, accountant, or attorney.

Table of contents

- What License Do You Need to Start a Cleaning Business?

- “How Do I Get a License for a Cleaning Business?”

- Step 2: Register Your Cleaning Business Name

- Step 3: Apply for a Business License (State + Local)

- Step 4: Get an EIN (If You Need One)

- Step 5: Insurance and Bonding (Not a License, But Don’t Skip This)

- Cleaning Business License Requirements by State (What Actually Changes)

- Common Licensing Mistakes New Cleaning Business Owners Make

- How Long Licensing Takes (and How Much It Usually Costs)

- Frequently Asked Questions About Cleaning Business Licensing

- What to Do After Your Cleaning Business Is Licensed

- Final Thoughts: Get Licensed, Then Focus on Running the Business

What License Do You Need to Start a Cleaning Business?

Let’s start with the most important thing to understand:

There is no single “cleaning license.”

When people ask “how to get a cleaning license,” they’re usually referring to a combination of basic business registrations that allow them to operate legally. What you need depends on a few factors, including:

- Where your cleaning business is located

- How your business is structured

- Whether you’re doing residential, commercial, or both

- Whether you plan to hire employees

That’s why answers online often conflict. They’re describing different situations.

In most cases, a cleaning business needs some mix of:

- A registered business entity

- A state, city, or county business license

- Proper insurance and sometimes bonding

Those are related, but they are not the same thing. Insurance, in particular, is often confused with licensing. Many clients ask for proof of insurance, which makes it feel like a license requirement when it isn’t. We’ll cover that distinction in detail later.

Another reason requirements vary is the type of work you do. Residential cleaning and commercial cleaning can trigger different rules in some areas. If you’re unsure where your services fall, Residential vs Commercial Cleaning: What’s the Difference? is a good place to clarify that before you move forward.

The short version is this: most residential cleaning businesses don’t need a special trade license, but some locations and certain types of work can trigger extra permits.

“How Do I Get a License for a Cleaning Business?”

Licensing a cleaning business usually isn’t one big form or approval. It’s a small series of steps that build on each other. Think of this as your basic compliance checklist for getting a cleaning business legally set up.

Here’s the overall map before we go into detail:

- Choose your business structure

- Register your business name with the state

- Apply for any required state or local business licenses

- Get an EIN if you need one (common if you form an LLC, hire employees, or open a business bank account)

- Make sure your insurance and bonding are in place

Now, we’ll walk through each piece so you can see what applies to your situation and what doesn’t.

Step 1: Choose Your Business Structure

Choosing your cleaning business structure is usually the first decision you’ll make, and it sounds more complicated than it is.

For most cleaning businesses, the choice comes down to two options:

- Sole proprietor

- LLC

A sole proprietor is the simplest setup. There’s less paperwork and fewer upfront costs. The downside is that there’s no separation between you and the business. From a legal and liability standpoint, everything is tied directly to you.

That’s why many cleaning business owners choose an LLC. An LLC creates a separate business entity, which can offer protection if something goes wrong. It also tends to feel more legitimate when opening a business bank account, getting insurance, or working with commercial clients.

You don’t need to decide this perfectly on day one, but it does affect how you register your business and apply for licenses.

Step 2: Register Your Cleaning Business Name

Once you’ve chosen a structure, you’ll need to register your business name.

If you form an LLC, your business name is registered with the state as part of that process. If you’re a sole proprietor and want to operate under a name that isn’t your personal name, you’ll usually register a DBA. DBA simply means “doing business as.” It tells the state or county who’s behind the business name customers see.

This step is often referred to as cleaning business name registration. It’s what makes your business name official and searchable in state records.

Requirements vary by state, but this is typically handled at the state level and sometimes at the county level as well. It’s usually straightforward and can often be completed online in a single sitting.

Once your name is registered, How to Brand Your Cleaning Business walks through how to brand and market your new cleaning business.

Step 3: Apply for a Business License (State + Local)

This is the step that causes the most confusion.

When someone says “cleaning business license,” they’re usually talking about a general business license issued by the state, city, or county. Most cleaning businesses don’t need a special industry license, but they do need permission to operate in the places they serve.

Here’s where people get tripped up.

Some states require a statewide business license. Others don’t. Many cities and counties issue their own local licenses, even if the state doesn’t require one. That means you could be fully registered at the state level and still be missing a local requirement.

This is also the step most owners accidentally skip. They register their business name, get insurance, start booking jobs, and assume they’re covered. Then a client asks for a license number, or a city sends a notice in the mail.

The practical way to approach this is to check:

- Your state’s business licensing requirements

- The city where your business is based

- Any additional cities or counties you actively serve

If you need help researching what your state requires, search for your state on the ZenMaid Magazine, and you’ll get state-specific information.

You’re not looking for complexity here. You’re just confirming whether a general business license is required in each location. Most local business offices can answer this quickly, and many publish clear checklists online.

Pro Tip: Once you’re licensed, it also affects how and where you show up online. Your business address, service area, and licensing status all tie into local visibility. That’s where Local SEO for Cleaning Businesses and How to Get Your Cleaning Business to the Top of Google Maps come into play later on.

Step 4: Get an EIN (If You Need One)

An EIN is a federal tax ID number for your business. Not every cleaning business needs one, which is why this step often causes unnecessary stress.

You generally need an EIN if:

- You form an LLC or corporation

- You plan to hire employees

- You want to open a business bank account in the business name

You generally don’t need an EIN if:

- You’re a sole proprietor with no employees

- You’re operating under your own name and using your Social Security number

Many cleaning business owners choose to get an EIN anyway because it’s free and keeps their personal SSN off invoices and forms. It’s a practical choice, not a requirement in every case.

This step becomes especially relevant once you start thinking about hiring. Whether you’re bringing on employees or working with contractors, How to Hire Cleaners for Your Cleaning Business and 1099 vs W2 Cleaners Explained can help you understand how your tax setup fits into those decisions.

Next, we’ll cover insurance and bonding. This is where licensing and compliance often get mixed together, and where a little clarity can save you a lot of back-and-forth later.

Step 5: Insurance and Bonding (Not a License, But Don’t Skip This)

This is where a lot of confusion comes from, so let’s be very clear:

Insurance is not a license.

Clients, property managers, and even some platforms use the word “license” loosely, which makes it feel like you’re missing paperwork when you may not be.

That said, cleaning business insurance is still a smart move for your cleaning business.

Insurance protects you if something goes wrong on a job. A broken item, an injury, or damage to a client’s property can turn into a serious problem fast without coverage. For many clients, proof of insurance is also a trust signal. It shows that you’re running a legitimate business and not just doing side work.

This is why you’ll often hear clients ask whether you’re “licensed and insured,” even though those are two separate things.

Bonding is related but different. When a cleaning business is bonded, it means there’s financial protection in place if theft or dishonesty occurs. Bonding isn’t always required, but some clients specifically look for a bonded cleaning business, especially in commercial settings or higher-trust residential work.

The important thing to remember is this:

- A business license allows you to operate

- Insurance and bonding protect you and your clients

They work together, but one doesn’t replace the other.

Cleaning Business License Requirements by State (What Actually Changes)

Licensing rules for cleaning businesses do vary by state, but not as much as people tend to think.

What doesn’t change is the foundation. In most states, cleaning businesses are not required to hold a special trade license. Instead, they’re expected to register as a business and follow the same general rules that apply to other service-based companies.

What does change is where that registration happens and how it’s handled.

Some states require a statewide business license. Others don’t issue one at all and leave licensing to cities and counties. In those cases, local business licenses are what matter most. This is why two cleaning businesses doing the same work can have very different requirements depending on where they’re located.

For example:

- In states like California, businesses register at the state level and may also need local licenses depending on the city.

- In states like Texas, there’s no general statewide business license, but many cities require local registration.

- In states like Florida, requirements often depend heavily on the county or city where the business operates.

The details vary, but the pattern is consistent. You’re usually dealing with a mix of state registration and local permission to operate, not a specialized cleaning credential.

The fastest way to check your own requirements is to:

- Look up your state’s official business registration website

- Check the city or county website where your business is based

- Confirm whether additional licenses are required in nearby service areas

Common Licensing Mistakes New Cleaning Business Owners Make

Most licensing issues don’t come from doing something wrong. They come from missing a step or assuming something counts when it doesn’t.

Here are the most common ones we see:

- Assuming insurance equals a license — Insurance protects you. A license gives you permission to operate. You usually need both

- Skipping city or county requirements — State registration alone isn’t always enough. Local licenses are easy to miss

- Waiting until after booking clients — Licensing is simpler when it’s handled upfront, before you’re juggling jobs

- Overpaying for unnecessary filings — Many owners are sold add-ons they don’t actually need for a cleaning business

- Not updating registrations when things change — Adding employees, changing locations, or switching structures can trigger new requirements

How Long Licensing Takes (and How Much It Usually Costs)

For most cleaning businesses, licensing doesn’t take months or cost thousands of dollars.

In many cases:

- Registration and licenses can be completed in a few days to a few weeks

- Costs usually range from modest filing fees to a few hundred dollars total

The exact timeline depends on your location and how many local licenses are required, but this step is often faster and cheaper than people expect. Compared to equipment, insurance, or marketing, licensing is rarely the biggest hurdle.

Frequently Asked Questions About Cleaning Business Licensing

How do I get a cleaning license?

Most cleaning businesses don’t need a special industry license. You’ll typically register your business and apply for any required state or local business licenses instead.

Do I need a license to clean houses?

In many areas, you’ll need a basic business license and/or local registration to operate legally. Some places are lighter, some are stricter. While there’s no “house cleaning license,” you usually need to be registered as a business and comply with local licensing rules.

Can I start a cleaning business without a license?

You can plan and prepare, but operating without required registrations or licenses can lead to fines or issues with clients. It’s best to get set up first.

What happens if I don’t get licensed?

At a minimum, you risk penalties or being asked to stop operating. It can also affect your ability to get insured or work with certain clients.

How do I get licensed and insured for a cleaning business?

Licensing gives you legal permission to operate. Insurance protects you and your clients if something goes wrong. Both are usually required to run a professional cleaning business.

What to Do After Your Cleaning Business Is Licensed

Once your paperwork is handled, the focus shifts quickly from setup to operations.

This is where systems start to matter. Scheduling, client communication, and keeping track of recurring cleanings become part of everyday work, even with a small client list.

ZenMaid is used by thousands of licensed cleaning business owners to manage clients, schedules, and communication once they start booking recurring cleanings.

Final Thoughts: Get Licensed, Then Focus on Running the Business

Licensing is a hurdle, but it’s a finite one.

Once it’s handled, you can stop second-guessing paperwork and start focusing on the parts of the business that actually move things forward. Serving clients well, staying organized, and building systems that support growth matter far more in the long run.

Getting licensed is about legitimacy. What you do after that is where the real business begins.

If you’re still in the early planning phase, it can also help to read How to Start a Cleaning Business and listen to this podcast episode about realistic income and expenses for cleaning business owners.

QUICK TIP FROM THE AUTHOR

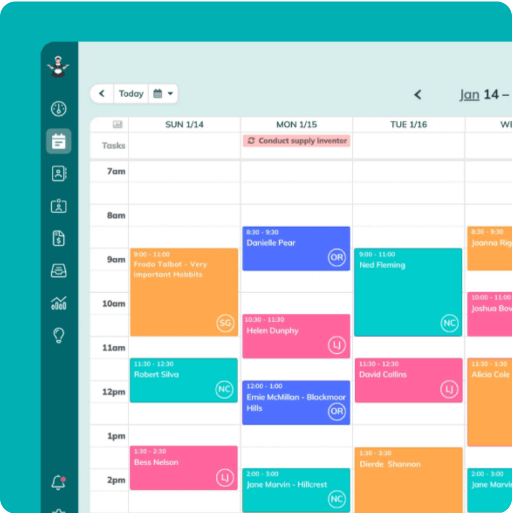

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.