Brought to you by expert maid service owners

Listen on: Apple Podcasts, Spotify or YouTube

Introduction

Hello everyone, welcome back to the Filthy Rich Cleaners podcast. I’m your host, Stephanie from Serene Clean, and our lovely guest today is Chris Schwab back on his second round here on Filthy Rich Cleaners. Chris, thank you so much for joining me for our deep dive into independent contractors.

Chris: Thank you for having me on. Thank you for tolerating me in the community, so I’m excited to be here.

Stephanie: Well, tolerate is the wrong choice. I enjoy your content greatly. Chris is always putting out really high value stuff. If you are not following him, I highly suggest that everybody. Chris is over in Japan, and he has what, 10 years of remote ownership, or is it longer now?

Chris: This is my 10th year, actually.

Stephanie: Your cleaning business is in Washington, DC, correct?

Chris: Yes.

Table of contents

- Introduction

- Understanding Independent Contractors vs Subcontractors

- Why This Model is So Popular Despite Problems

- The IRS Guidelines and Tests

- Financial Control Test

- Relationship Control Test

- Critical Red Flags to Avoid

- Types of Cleaning Jobs and Risk Levels

- Quality Control Challenges

- Handling Quality Issues

- Scheduling Complexities

- Managing Regular Clients

- Communication and Data Privacy

- Insurance Requirements

- Training and Test Cleanings

- Finding Independent Contractors

- Payment and Rate Setting

- Branding and Uniform Restrictions

- Payroll and Payment Systems

- Compliance Challenges and Roadblocks

- The Hybrid Model Problem

- Transitioning Between Models

- Business Emergency Fund Advice

- Final Thoughts

Understanding Independent Contractors vs Subcontractors

Stephanie: Chris has always ran ICs based on our first conversation. If you haven’t listened to that, go listen to our first episode which is actually the sixth episode on the podcast. When I talked about independent contractors a few weeks ago in a solo episode, I sent it over to Chris. I was like, hey, would love to get your thoughts, considering you have experience in this where I am just observing from afar as somebody who’s always ran W-2. So I am looking forward to hearing a lot of your insights. Obviously, caveat, you are not a legal representative or expert. You are a business owner who has experience in this area.

Chris: Just emphasize bold, italicize that caveat. I’m not in any way a legal expert, but I am an owner who has a lot of experience doing this. I’ve worked with others who also do this. I’m happy to speak on the basics for everyone here to make sure that we’re not grossly doing something wrong, which there’s a lot of in our industry.

Maybe a good place to start might be the difference between a contractor and a subcontractor, just because there’s a lot of term confusion in our industry.

A contractor is someone who typically has direct contact over the whole project with the client. You would employ the contractor to work with that client directly. They would accept payment from the client. They’d have ownership of the scope of work. So they’re their own independent entity doing work for the client.

But a subcontractor, which is what a lot of cleaning companies use, is someone who is hired by the company to perform a very narrow scope of work and receives payment from the company rather than the customer or client. So what we’re going to be talking about today is more independent contractors, subcontractor relationships than we are construction industry contractor.

Why This Model is So Popular Despite Problems

Stephanie: Considering this is such a huge issue in a lot of industries, but very specifically the cleaning business, why do you think this is such a problem? Why are we beating our heads against the wall of people going this route? Why is there still such massive misinformation around this topic?

Chris: There’s kind of macro and micro reasons. Macro reasons are more employment law related at the state and federal levels. There’s a lot of discussion the past 10 or 15 years about what makes an employee, what makes a subcontractor. These are relevant to bigger companies like Uber or Homejoy and Handy, who have all had problems trying to not pay payroll tax, trying to really classify someone incorrectly, because it’s much cheaper in terms of taxes and financial burden on the company to classify someone as a contractor than an employee.

There’s also a micro level within our industry, within the cleaning and home services industry, where a lot more people are choosing to use subcontractor models because it’s easier, and at certain points it is more profitable. At certain points it’s not profitable, but it’s much easier and less of an administrative burden to hire someone as a contractor than as an employee.

The one I see most in my coaching practice is people choose it for the ease of the model. It’s very minimalist, in that you can just hire someone, tell them to do the job, pay them, and that’s it. You can’t really do that with employees. There’s a lot more that goes into working with an employee, training them, quality control. A lot of that is not present in the subcontractor model.

Someone who wants an easier type of remote cleaning business, they’re drawn naturally to this type of model, because there’s a lot of things you don’t have to do that you would normally have to do.

The IRS Guidelines and Tests

Chris: The guidelines for what makes an employee, what makes a subcontractor, independent contractor, they’re set at the federal level by the IRS. They have a set of guidelines which you have to follow to ensure that someone is properly classified. But there’s also state level laws for how strictly or how loosely they consider the IRS guidelines. You actually have to be compliant with federal and with state and sometimes with county level laws too.

The default position of the IRS is that you’re an employee and you actually have to meet criteria to be a contractor. So it’s not a pick and choose. It’s by default, someone that you hire as an employee, and you have to prove that they’re not an employee. You’re actually starting from a disadvantage as a cleaning business owner if you’re choosing to use the contractor model.

There’s a key set of three IRS tests that they do, which is the surface level check of pass or fail. That’s a behavioral control test. So that’s how you control working with the worker, and if you control large parts of how they do the job – if they have to follow a very specific method of cleaning, if they have to use certain types of supplies, if they have to do certain things during the job – you’re exerting significant control over that worker that would classify them as an employee.

If they’re an independent contractor, they have independence over how they do their job. You do not exert control. You can give the job to them with a specific set of requirements for that job to be completed, but you cannot control how they do it, because then they’re no longer independent.

Financial Control Test

Chris: The second one is financial control. This is one that a lot of people get wrong in the cleaning industry. You cannot set their rates. You cannot provide them supplies. You cannot reimburse them for gas. You cannot be their only client either. This fourth one is the one that people get wrong a lot.

A lot of people know now, oh, we can’t provide them supplies, and that’s a benefit in a certain way. But what they don’t know is you should not be that independent contractor’s sole source of income. They’re their own independent entity with their own insurance and their own clients, and you are one of their clients. You’re subcontracting them out to do a job.

If you’re their sole source of income, and you control their schedule, and thus their financial income, that would then mean that you fail the financial control test, and they would be determined to be an employee. So you cannot actually control their entire income.

We want our contractors to have our clients when it fits their schedule, but to also have their own other clients. That’s actually a good thing. This is good when you’re starting too, because then you don’t have to keep a full schedule for them.

Relationship Control Test

Chris: The last one is a relationship test, and this is the other big one that a lot of people fail. Employee relationships can be long term and permanent, forever, but with contractors, there’s typically project time limits on the relationship. You can’t just have an open ended thing saying you’re going to work for me for the next 10 years whenever I want you to. That’s a permanent employee type relationship.

With an independent contractor, you’re typically setting a rate, you’re setting a scope of work. You’re not supplying them with any employment type benefits, and there’s some temporary nature to the work that you give them. So they’re not doing the same house for 10 years in a row on the same schedule, on the same pay. The relationship has to be different and less permanent than an employee relationship is.

Critical Red Flags to Avoid

Chris: There’s some really deadly red flags that you just can’t do. If you do them, you’re going to fail. You cannot provide them company uniforms, because they’re not part of your company. They’re independent contractors. You cannot provide them with detailed cleaning checklists. You can have basic checklists as a scope of work that they need to do, but if you’re doing 100 point checklists and the contractor has to do all 100 points, you’re controlling how they do the job again, so you’re exerting behavioral control over them.

You cannot set their work schedule. You actually have to ask them proactively for their availability. You cannot demand that they are always at this house at this time. You have to ask them and request regularly that they can do this job and it fits within their schedule. So you cannot control their work schedule either.

Types of Cleaning Jobs and Risk Levels

Chris: There’s different types of cleaning jobs – carpet cleaning, post construction cleaning, move in/move out, standard weekly home cleaning. You can think of some of them as safe territory and some of them as a danger zone.

If it’s a temporary job, like a single carpet cleaning or a single post construction clean, that’s not really exerting schedule control because it’s temporary or ad hoc jobs. But if you’re doing a weekly house cleaning route where it’s always the same route, that is actually setting the schedule for the contractor, and that would be a danger zone.

You would probably fail if you’re doing weekly house cleaning routes with the same team and the same schedule all the time for years on end under the contractor model, and a lot of people don’t realize that, because that’s the cleaning business model we use.

Quality Control Challenges

Stephanie: When I think of my clientele, something that’s very important to us is trying to keep the same cleaner on the same house, because it makes it easier for us and because of the consistency of the schedule. How do you circumvent that? I’m assuming rotating teams, but that’s a whole other host of problems.

Chris: You brought up a very good point. There’s a point in a company’s business where quality control becomes more important in order to grow. It’s always important in reality, but you’re going to hit a plateau until you actually fix quality control.

This is something that we see with the contractor model. Generally somewhere around the 50 to $60,000 a month mark in house cleaning, I see contractor model based companies start to top out and plateau without some serious reform. It’s because they have a dozen or more contractors now doing work for them, but they all have different quality standards because they can’t control the quality the way that an employer can.

At the beginning, I find that running a contractor model is easier as a business owner in the first couple years, because there’s less hassle to worry about. You can focus more on growth. But at a certain point, as you really start to scale, it’s much harder to scale with a contractor model than an employee model.

Handling Quality Issues

Chris: You can’t say, hey, you screwed up, go clean that. You can’t go back and do that and fix it because they’ve completed the job in the way that they’ve decided to complete it, which is their right as an independent contractor.

What you can do is build into your subcontractor agreement that you’re able to withhold part of that job’s payment if the client is unsatisfied. We’ve never actually called anyone on this in 10 years, but we have it in our contract that we would be able to withhold up to $50 from that job if the client is clearly unsatisfied.

The other thing that you do in a practical manner is you incentivize them to go back and fix it. You can say, hey look, I’d like to send you on another job, back to that same house to clean these missed areas. I’ll pay you 80 bucks. It’ll take about an hour. Could you do that? Most of the time, when they understand something’s been missed, they will understand, and they will accept that.

What we do instead is next time we have a cleaner who’s going near that route, a different team will say, hey look, actually, another team missed this area. Would we be able to pay you extra today to go and cover for those areas at that home? So we typically send a different team back for that quality control issue and pay them for that.

We regularly tell them, hey look, we did our follow up call the next day with the client. They did say there was a few areas missed, this and this. I wanted to notify you about that, because I’ve noticed this happening a lot the past couple weeks. How’s your workload? Do you feel like you might want to do just two houses a day instead of three? We talk to them about it, and most of the time now, our teams are pretty good. It’s not an issue.

But early on, the first few years, I had some real arguments with cleaners, and that’s not fun, but that’s also an opportunity for us to learn if maybe there’s a personality mismatch for the company. We use those conversations with contractors, not necessarily as a litmus test, but we’re very open about the feedback with them and see if they’re going to improve or not. And if they argue a lot with us, we might end it there.

Scheduling Complexities

Stephanie: From a scheduling perspective, how is it that for planning purposes, are you able to manage the schedule every single week? Is that not pure chaos?

Chris: I’ve heard you say this to other people, if you’re a micromanager, you’re going to be screaming during this podcast because the contractor model doesn’t allow you to control everything.

Stephanie: It sounds like hell to me.

Chris: Sure, it does. We do it a few different ways. This is another advantage of the contractor model. If you have part time employees, you still have to pay them part time. If you have part time contractors who have other clients, you can pay them when work comes in, but you don’t have any obligation to pay them some sort of hourly rate to just be idle.

We always have more contractors than we need on file. So if we need 10 contractors to be fully booked, we might have 14 or 15, because they all have their own clients and schedules too. In an ideal week, even though we may only need 10 contractors, in reality, some of them are going to have Monday morning booked, or some of them are going to have Thursday afternoon booked that week.

We have backup contractors always available, or other cleaning companies that we trust in the area. I know three other cleaning company owners in the DC, Maryland, Virginia area very well. When we’re overwhelmed, we actually send them jobs and take a much smaller percentage, like 20% instead.

When we book a client in, we get them booked in the schedule first, and then we approach the individual contractors we think would be a fit for that job. We do that by building a profile of them over time, by seeing what jobs they do well. If it’s a solo contractor, we only typically book them in for jobs of sizes up to two bedrooms and two bathrooms, because beyond that, it’s a lot for one person to do more than one a day. If they’re a team of two, we typically book them up to four bedroom, four bathroom size. And if they’re a team of three, they’re reserved for our bigger jobs, or our move out, move in cleans.

We actually kind of filter based on different types of jobs, which contractors would be good for that type of job. And then within that subcategory of contractors, we will approach the ones we think are the best fit. If they’re busy that time, we’ll move on to the next person. And if they’re all busy, we’ll have a group chat where we’ll say, hey look, we have this job on Thursday, we haven’t been able to book it. Would anyone be able to take this job? So we’ll then put it out to the whole team, and then the first to get it, gets that job.

Not ideal, but that’s how you do it.

Managing Regular Clients

Stephanie: What about the maintenance cleans? What is the rule of how frequently a particular contractor can go to a particular job site?

Chris: I’ll tell you what I do, but I’m just going to be very upfront with everyone. I don’t have a clear answer for this one either, and I’ve tried finding one, but there is no forthcoming clear answer. I’ve actually approached state authorities with this question, but no one will give a clear answer.

What we do is we renew our subcontractor agreements every year with them. They sign a fresh subcontractor agreement, and we renew that job with them, and we say, can you do a job for the next six months or the next year at this location, at this time? And then it’s a time limited contract.

There’s a difference the IRS charges between unintentionally misclassifying someone and intentionally misclassifying. The penalties are different. We know that this is a gray area that we’re trying to proactively manage with the house cleaning routes, because we’re trying to very intentionally follow the rules. If we unintentionally fail a test, the penalties will be less severe.

That’s why you need to be aware of these things, even if you don’t have a clear answer, because you can create a paper trail of good faith that you’re trying to be compliant. The IRS penalties are, I think, 100% of FICA taxes if you intentionally misclassify someone, plus daily interest plus criminal charges. So the penalties for unintentionally versus intentionally misclassifying are very different.

Communication and Data Privacy

Stephanie: Is there any communication that happens between the IC and the client directly? Or is that always managed through you guys? Because that’s something that’s very important to us. The client does not have the cell phone numbers from a safety perspective, of course, as well. But more so I don’t want all instructions coming through the office. For example, hey, don’t do this room today. That needs to come to the office, and then we communicate that to the staff member. How does that work for you guys?

Chris: Actually, this is a small question but kind of a big topic, because it brings in data security too into the equation. This goes back to our very beginning of the podcast, defining the contractor, subcontractor difference. With contractors, they manage the relationship directly with the client, and they’re paid by the client. Subcontractors don’t primarily manage the relationship with the client, and they’re paid by the company.

We manage communication with the client until they arrive at the job, and then obviously, when they’re cleaning, they’re communicating with the client. That would be very strange to say I can’t talk to you, call the office. Up until they arrive and until they leave, we manage communication.

If they want to upgrade, because sometimes we arrive for a first time clean, and they didn’t want to book the deep clean for their first clean, but really it should have been a deep clean, they’ll text the contractor. The contractor will text us and be like, hey, this is eight hours of work, not two. And so we will call the customer and explain, you need to upgrade this cleaning if you want us to do this job. But the majority of the communication is done through the office, and that’s part of the advantage for the subcontractors is that we manage the client relationship for them, so they can just do the cleaning.

Data privacy is important in how you manage data as a company with subcontractors versus employees. If you have employees and the client’s private information is internal to the company, it’s handled differently than if you subcontract the work out to someone and give that client’s private information, like address, like lockbox code to the subcontractor.

Stephanie: I didn’t even think about that. We have such stringent confidentiality clauses in our employment agreements. I’m assuming you can have that stuff, but the nature of the business, you have to put the address and all of these details out right?

Chris: Address, access to the home, access to their personal belongings. And so this is different, and it’s something you should talk about with your insurance company, not with me, but data privacy, access to belongings, codes, entry to the home. These are actually handled differently depending on it being an employee of the company and someone you’re subcontracting out to who’s an independent entity. So it’s just something to be aware of, and it’s beyond the scope of me talking about today.

Insurance Requirements

Stephanie: I definitely want to segue into insurance because obviously, insurance in general, I think is a huge topic in this realm. I have heard of horror stories where, oh, I’m running ICs, somebody gets hurt, somebody breaks something. Oh, actually, they don’t have proper insurance or whatever. Or they’re trying to come back and say that it needs to be on the company’s workers comp. So as somebody who runs exclusively ICs, do you have a lot of umbrella policies that cover independent contractors despite them having insurance?

Chris: We do. We used to have a great one. They’re no longer in business, but there was one specifically for Ever Friendly Residential Cleaning Association. If anyone remembers them from years ago, they were specifically a cleaning association insurance company for companies using contractors. They don’t exist anymore. He closed it down a few years ago, but yes, we do have a few different policies that are important.

We also do, so this is kind of a two pronged answer. How you onboard a contractor is important, but then also how you insure them is important. So if I may reverse that for a minute. I know I’m throwing a lot at you in one podcast.

Stephanie: This is a deep dive. This is the point of this. I want to get into the nuance of it.

Chris: If you start falling asleep, let me know. I just took a nap.

Stephanie: Chris, I am laser focused. It’s eight o’clock at night.

Chris: Basically, I’m going to tackle onboarding first, if it’s okay, and then insurance, because it will make a little more sense then. The way that you onboard contractors, there’s a few different things you have to do differently than employees. The paperwork that you have to get is very different.

You have to have a subcontractor agreement. One thing that no one ever does, which I beg everyone to do is to go to an employment lawyer licensed in your state and just pay them a couple hundred bucks to review your subcontractor agreement and update it to make sure it’s compliant, because you need to be compliant with the federal and the state level. If you just copy someone’s subcontractor agreement online, which everyone does, you are going to get hit so hard if you’re not in their same state.

You need to fill out what’s called a W-9 which is tax information and legal information for that contractor. You need to have proof of insurance on file because they’re an independent entity, they have to have their own insurance on file for their legal entity too. Otherwise, you’re putting yourself and your clients at risk.

With an employee, that’s different. Your employee doesn’t have their own employment company type insurance because you’re insuring them as the owner. But with contractors, they must have their own insurance policy, and usually your own insurance policy will state that you have to have it up to date with them every year. So every year, you need to get a fresh copy of your contractor’s insurance on file. It doesn’t matter if it’s by email or whatever, but you need to have a fresh, up to date, compliant policy that they have on file.

When you’re onboarding them, you have to do those three things, but what you also have to do on your end is have insurance on your end. One of the difficult things about this model is most bonding is for employee based companies, not for contractors.

Stephanie: What about bonds? Because I was like, oh, what about bonds?

Chris: There are companies that do it. It’s a little difficult, it’s more expensive, but there are companies that do it. And you need an insurance policy which specifically states in the insurance policy itself that your company is using independent contractors to perform work. You cannot just get a normal small business insurance policy. You have to get one that specifically covers this or you’re going to be so screwed if you don’t.

Next Insurance is one that a lot of people use now. They’re okay, from what I understand. I’ve never heard anyone actually make a claim through them, so I don’t know how their process is for making a claim or not, but Next Insurance is a company that will specifically insure you if you’re a subcontractor model company.

So you do need different insurance, and the other one that you want to get is two others. You want a directors and officers insurance policy to protect yourself as a director officer of the company in cases of negligence. If you negligently do something incorrectly as an officer of the company, you need to make sure you’re personally protected.

The other one is employment liability protection insurance, EPLI insurance. This is for the first time actually, because we got sued. So I didn’t know I had that rider on my policy. And then I was like, oh, thank goodness.

Stephanie: I’m sorry to hear about that though. Are you doing okay?

Chris: Good actually. Side note, totally random, but there are people out there who have some type of technology to search out job listings that list anything about no felonies. So this man in New York sued us. He didn’t even apply or anything. He’s actually sued my parents’ company years ago. So this is what he does for a living, is sue companies because anything about felonies is specifically in Wisconsin considered discrimination.

For us, we never list that typically, but the federal research facility that we were hiring for, it was their policy, no felony. So that’s why we had it in there. Otherwise, I got plenty of felons on my payroll. We were fine with that in certain circumstances. But my insurance rider did have that and they were able to get a dismissal, no problem. But yeah, do not put that in your job listings.

Stephanie: How bold of him to go after both your family and you.

Chris: He didn’t even know it’s just he sues. I mean, I think that he does 80 cases a year at least. And so every single employment lawyer knows this guy by name, Richie Levine, if you’re watching, you can suck eggs, because this is what he does for a living.

Stephanie: What a hobby.

Chris: The other one is employment liability protection insurance for specific cases like this, which also covers accidental misclassification of contractors who should really be employees. So if you’re running this model, you want to make sure you have that insurance. Because even if you do everything in good faith, if you get audited by really strict state agency, you’re going to want that insurance to fight for you.

That’s kind of the answer to that question. There’s a few different policies that really add up. I know to business expenses, but 100 bucks a month total for peace of mind I think is worth it.

Stephanie: Absolutely, 100% for sure.

Chris: If I may actually, this is slight tangent, but I wanted to mention another small downside of this model. It’s one that I discovered recently, and I didn’t know because I run a residential contractor model, I don’t do offices or government buildings, but I recently learned that a lot of governments, medical institutions, schools only are allowed to sign contracts with employee based services for security clearances. So contractor models can’t even apply to ever do these types of jobs.

So anyone out there considering this model, if you’re going to go the commercial route, the commercial contractor model route is much more limited in who you can work with, so it really caps your growth potential.

Stephanie: That’s a good point, because that research facility that we’ve been there for a year and a half, and I mean incredibly high standards for background checks, and they must be we can’t send just anybody in there. And so they do not want turnover. They want the same people. Even though it is on a time limit, meaning it’s a five year contract that renews every single year. So that side of it would work well with contractors. But yeah, they don’t want contractors. Yeah, that’s a limitation.

Training and Test Cleanings

Chris: If you’re in this for the long term, I do generally recommend people go the employment route. If you’re doing the remote cleaning model that I do, I think contractors are better. It’s much easier to do it remote for various reasons. But if you’re a hardcore, you’re going to be doing cleaning as a legacy business, I think employees is the way to go, because you don’t have any restrictions. You just have a lot more paperwork.

Stephanie: There is a lot to it. But even in our first conversation, we kind of touched on this, of the values of having independent thinkers and people who can work really well without a lot of instruction. That works well in that model of what you’re desiring for your culture.

Chris: It does. And you can usually pick up more experienced cleaners too, cleaners who have 15, 20 years of experience, who struck out on their own. You can really get some true gems who you really can just give them the job, and you know they’re just going to do a good job every time, or they’re assertive enough to say, no, I can’t do this job. No, thanks.

Stephanie: I know a lot of people, they don’t do it that way. That’s a huge marketing tool for us. The checklist is the leave behind, has the QR codes. It has all of that promotional stuff on it as well. But for us, it’s just the accountability of it. Coming back to I just don’t think my very particular, controlling way of business, at least when it comes to the cleaning specifically, I’m not a psycho, but I am a psycho about I want it done in this way. We clean in this order in the house. Even you start here, and this is what you do, and all of these things because of the scaling of it all. I want everybody to be trained the same way. Obviously you can’t even train these people. You can’t even use that word training, correct?

Chris: There’s some debate about that actually. Bigger companies, but we’re too small to have their lawyers defend us, but some bigger companies have intakes, initiations, orientations for their contractors that take a week or a month, and they have training slides and training days for them. I don’t know how legal that is or not. To me, it would seem not legal, but I’m not a billion dollar company with million dollar lawyers to argue for my case. So I think in that case, you want to stay on the safe side and not train them. But there are companies that do. I just that’s beyond me.

Stephanie: If I recall you do test cleanings. You send them out to a test clean and see, have the client let you know, and that’s how you get them into your ecosystem?

Chris: Yes, but just to caveat, it’s a test clean for us, but it’s a real job for them, so we pay them the full price for those first few normal cleans, but it’s a test clean for us to see how they do. Do they arrive on time? Do they present well? Are they polite? Can they clean well? All those things. We cannot train them on those test cleans that we send them on first and pay for. Those are actually our kind of quality control early on, if you will, where we make sure that they know what they’re doing as a cleaner. Because we’ve had cleaners who say they have 20 years of experience, and it seems like they don’t even have two.

People lie, or they do have 20 years, but they just never got to a skillful level. So we do those test cleans. From our perspective as the company, it’s a test clean. So we don’t officially start giving them a large client roster until they pass those. But from them, it’s an actual job. They’re cleaning as normal.

This is something I had to implement when I moved from DC to Japan. I used to have cleaners come to my apartment and my girlfriend’s, and they would clean them. But we couldn’t do that when I moved. I didn’t have the place anymore. So what I did was I had friends and family number one, and then long term, trusted clients we’d already cleaned for. I would approach them and say, hey look, would you like a free deep clean this Thursday? We’re hiring a new cleaner. We really respect having you as a client. We’d love to get your perspective if they would be a good new cleaner for the ThinkMaids team.

This actually does two things. It gives us the quality control aspect, but also, if they’re not a good cleaner, because they cleaned for a long term client who already has goodwill built up with us, they like to tell us the things that they did wrong, and they don’t get offended if it was a bad job.

If we just send this new cleaner to a totally new client for the first time, you’re just taking a huge gamble and hoping it turns out right. So we try and have the new cleaners work with older clients or friends and family first, just to make sure if something does go wrong, it’s with people who have goodwill built up with us, who will tell us the issue.

Finding Independent Contractors

Stephanie: What I wanted, I have two questions, specifically, when you were talking about moving to new areas and expanding. In our area, it’s very rural. The town that is in is 5000 people. Our second location is 10,000 people, and the third is 50,000 people. So it’s very, very rural. Nobody runs independent contractors. That’s why I didn’t even consider it, because I’m like, this isn’t even possible in my area. This doesn’t even it’s not even a thing. So for you, where do you find independent contractors versus an employee? Is it, I mean, you just put a smoke signal out or something, I don’t know, hey, we got work.

Chris: I’m imagining Batman Bat Signals now, or something, you know.

Stephanie: That was terrible. I apologize to everyone.

Chris: I’m going to AI that for Chris.

I will try and keep this concise, because there’s a dozen different things that we do. One of the things we do in smaller service areas to find contractors is we look for people who are actually contractors, but they don’t know it. You might go to Care.com for example, and those housekeepers are typically contractors. They’re not employees for the families, but they don’t know it.

We will approach families on Nextdoor or on Care.com and we’ll say, hey look, our cleaning team is expanding. We love hiring cleaners who already have happy families that they’re working with. Do any of the families in our neighborhood have a cleaner that may be looking for a little extra work and would want to join our team? So we typically ask families who already have good cleaners, because we’re contractors, we don’t need to provide them with a full schedule. They might only need a few extra jobs each week. And so we find already happy people and ask them to ask their cleaners if that cleaner needs extra work. And if they can, could they contact us? And then we can give them little referral bonus if they do.

Number two is we reverse the marketing platforms that we find clients with. We reverse that to find teams. I’ve done this for many years now with Thumbtack. You make a profile on Thumbtack, you bid on customers’ quotes, and then you call them and try and close the quote. Well, I bid as a customer for an independent contractor team, because you can see all the reviews, their background check, how they respond if they’re polite or not. You can get a sense of the quality of this contractor upfront, before you ever work with them.

We will bid as a company, but as a customer, and then we will approach those contractors and say, hey look, we’re a cleaning company that’s growing really quickly. We would love to work with you. Would you like to talk with us this week? And a lot of those good contractors are willing to talk to us. We’ve got a couple who are pissed off because it costs money, and we always refund them that money, but we actually use Thumbtack as a cleaner lead generating source.

The other is actually Facebook ads in different languages. English, French, Spanish. We have something like Pipe Hire or another funnel software, where we will do simple Facebook and Indeed campaigns, and we will funnel them into our main cleaner lead funnel. So couple different thoughts there. That’s how we find contractors in smaller service areas, and in bigger service areas, it’s a little bit different and easier. But in smaller service areas, you have to get pretty creative.

Stephanie: That is incredibly creative. I’ve never, my mind is blown because I’ve gotten this question before. I’m like, I don’t know what to tell you, because I use Indeed just like every other cleaning company that does W-2. This is really great information.

Payment and Rate Setting

Stephanie: I’m thinking about pay because, I’m talking to people who are like, yeah, I run ICs and I pay them $25 an hour. One, can you pay them an hourly rate? Is that legal as long as they are the ones who set it? But you can’t have an Indeed job listing out for independent contractors at this is what the job pays. How does that work?

Chris: You cannot set the rate. They can set the rate, and you can accept the rate that they set or not. You can have a discussion with each other and say, look, this is what I’m considering offering. Would that be acceptable to you? Would you set your rate at that? You cannot say your rate’s 22 bucks an hour. That would be exerting financial control and limiting their ability to earn, which would fail the financial control test.

You can do hourly rates, as long as they’re able to accept it. But flat rates is the standard for the contractor model. It’s what we do, and it’s more transparent for them when you do a 50/50 split, or 55/45 split, when everyone’s clear on what everyone’s job is and what they’re doing. It’s nice because they can earn a lot more per hour on the contractor flat rate model than they can on an hourly model usually, and they like it more because they’re paying for supplies and gas and a bunch of other business expenses that they have.

For us, at least, it works better to pay our teams more and to profit a little bit less, because it keeps them very happy and happy teams are happy clients.

Stephanie: Even things like gas. I’ve seen people who have fleets of cars and they’re running ICs. You can’t provide them a vehicle, I assume, right? Or a work wrapped car. Can you do that?

Chris: I’ve seen people make some fringe arguments that you can. I’ve also seen people make some fringe arguments that you can provide uniforms. And I don’t think any sane person could interpret those laws that way.

Branding and Uniform Restrictions

Stephanie: How does that affect you from a branding perspective? I want my staff to have their Serene Clean clothing on and all of that.

Chris: Actually a couple different ways. So there are some sensible limitations you can put, and it wouldn’t necessarily be the misclassification thing, but it would be your subcontractor agreement that would take precedence here. They’re not allowed to solicit your clients, and that might fall under things like they can’t give their business card out to your client. They should not wear their own company’s branded shirt. If I’m ThinkMaids, and they’re Jonathan Maids, they shouldn’t go to the cleaning with a Jonathan Maids shirt because that could be construed in some way as soliciting your clients.

You can put some sensible limitations on what they bring to the cleaning. Their own company stuff and business cards, big no. Your stuff, maybe you can’t do that. You can ask them to leave something behind though.

One of the things that we do is, when we do a move in or move out clean at the final service for that client, we leave a little brochure. This house was cleaned by ThinkMaids. If you ever need home cleaning, we used to clean for the previous resident for X amount of years. We’d love to give you a permanent discount if you call us. By the way, maybe you don’t need cleaning. If you ever need electrical engineering, if you ever need plumbing services, give us a call and we’ll connect you with a great local contractor in that area.

We leave that behind, and you’re allowed to do that. People do that. So we’ll get the new tenants always call us for services, and then we can get a little referral bonus by referring them to a plumber or someone. So a little growth hack there for you guys.

Stephanie: We kind of touched on checklist, and you can’t have extensive checklists, which would totally nix my cleaning checklist, but you can give them basic scopes of work. Can you require them to leave behind a completed scope of work for the client? Can that be required?

Chris: It’s a good question. I don’t know. We haven’t done it. I just don’t know the answer. I’m sorry.

Payroll and Payment Systems

Stephanie: I don’t know how you pay your folks.

Chris: We use Gusto. I use them for years. There’s no one that comes even close to them. I’m a lover of Gusto. Their customer service, I mean, just, I’ve been so wildly impressed. And so I’m curious, do they help a lot with compliance when it comes to this?

They make it easy to pay contractors, but they don’t help very much with compliance. So if you ask them proactively, they won’t reach out to you about it, but if you ask them, hey, am I screwing up here? Do I need to correct something? They’ll let you know what to do.

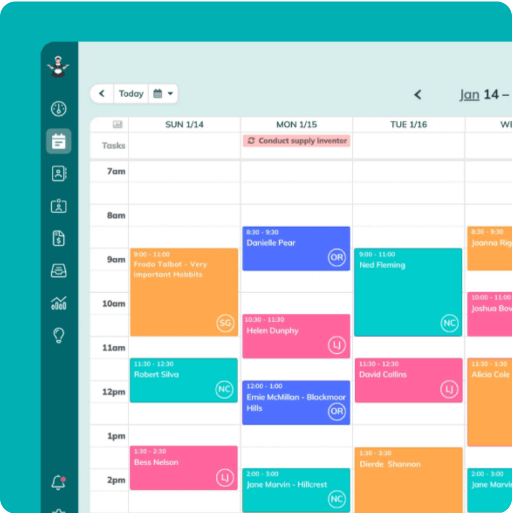

The way that we pay our contractors is weekly. So every Friday morning we send our payroll by Gusto for the previous week. So the previous Friday to the current Thursday is our pay schedule. And then that current Friday we pay for those days, and then it arrives Tuesday, two business days later. So we just do weekly, we do a percentage based. So we draw it from our booking software. Pitch for ZenMaid here. We will draw it from our booking software, and we will paste it into Gusto and pay. So nothing complicated at all.

The only thing to be aware of, and Gusto does help with this, which is nice, is you have to file a 1099, and send it to your contractors at January 31 each year for the previous year, and Gusto will produce those for you. This is a good one. I’m glad you asked this now. So they’ll produce them for you, and they can send them out by mail for three bucks a contractor, or they can email them to the contractors for free.

But there’s one really cool thing that Gusto does let you do. There’s something called a historical payment that you can do for payments that you made outside of Gusto, like if you paid your contractors by PayPal because Gusto was down, or you paid them by Venmo or something. You can actually enter all those outside Gusto payments into Gusto as a historical payment. So when you do payroll, it will process it for their 1099 but it won’t take extra money out of your account.

This is great for making sure that your 1099s are correct for all your contractors. You can actually take all those other non-Gusto payments for the year and put it in Gusto, and they’ll process it for you. So they do help with that part, but that’s it. They don’t help with anything else. They don’t send us news about it. So you kind of have to keep up to date on it yourself.

Stephanie: Definitely a plug for Gusto. Anybody who’s interested in a good payroll software. I use QuickBooks Online starting off, and honestly, I just had so many nightmares. I mean, we still use them for bookkeeping, but the actual payroll side of them, I want somebody who really knows their stuff. So big fan of that.

Compliance Challenges and Roadblocks

Chris: One of the things that I think is partially mindset as business owners, we’re always trying to find little hacks and workarounds to grow our companies. I think a lot of people unconsciously can do that with the contractor model, where it’s easier to just let something happen rather than make sure that you’re compliant, because there’s a lot of little edge cases.

There were some major lawsuits about 10 years ago in the industry when I was just starting, which is why I did deep dive into this. Originally, there’s two companies. There was one called Homejoy, which no longer exists, as far as I know. They were sued in 2015 for $40 million by the IRS over misclassification suits. And Handy was also sued for $6 million a few years ago, for I think 12,000 misclassified workers or something like that.

It wasn’t that they were just being grossly negligent, although they were in certain ways, but that there was a lot of little things they got tripped up on. So with this model, one of the things that is a roadblock for me and others, I think, is staying on top of compliance and staying on top of enforcement.

For example, most people will not have heard this yet, but back in May 2025, just a couple months ago, the Department of Labor just announced that they’re no longer going to enforce the strict 2024 enforcement rules around contractor misclassification. So now they’re using the 2008 framework that they used to use.

I know this is going to sound like a lot of industry jargon, but basically there’s different rulings on how they’re going to enforce things over time, so the same rules might be enforced more loosely or more strictly over time. They just announced three months ago that they’re going to less strictly enforce them, which would be good news for contractor models. But what’s important is the IRS rules and state laws remain unchanged, so they might not enforce them, but you still have to follow the rules, and if you get audited, you’re still going to get screwed.

So one of the roadblocks is keeping up with industry news, because it’s not necessarily specific to the cleaning industry. It’s specific to federal or state level.

The other one, besides quality control, is team culture is a big one. So if you do a contractor based model, you’re not going to have much or any of a team culture, which to someone who lives abroad and is not able to be there is a benefit. But if you’re a very leader, team culture oriented business owner, and you want to have team get togethers, and you want to do all this stuff, the chances of that happening with a contractor model are slim to none.

If team culture is important to you, you just have to recognize the only team culture you’re going to have is going to be you and your office managers. You might get close individually to some teams, but they’re not going to know each other. They’re not really going to care about each other at all. It’s not going to be a working environment.

The last one is around geographic expansion. One of what we do is, until I exited, we were buying small cleaning companies in various states like Texas and Florida, and rolling them up into my main cleaning company, and then having a VA run that location instead of the owner. So we would instantly make it more profitable, because the owner no longer had to take a salary. It would be $2,000 a month for the VA, as opposed to $6,000 for the owner. So we would instantly, from day one, make it more profitable and standardize.

But one of the downsides was, working with contractors in different locations, as you expand geographically, is very difficult. The administrative load to make sure that you’re complying with all the different state level tests, but also trying to standardize your operations across states is an enormous headache, and most people are just not going to do it.

We tried to do that, but it’s really expensive legally to make sure you’re compliant, and really frustrating to work with all the different state level agencies. So the time and administrative burden of expanding geographically under a contractor model is really burdensome in a way that it’s not when you’re in a single state.

Stephanie: That makes perfect sense. And state laws do differ somewhat with W-2s. I mean, frankly, just as long as you’re erring on the side of caution, obviously, don’t discriminate, don’t break any laws. And I feel like this is going to sound bad, but Gusto our payroll software, they’re always telling us when things are coming our way of changing, and almost we don’t really have to stay on top of it, because our payroll software is really keeping us up to date very well.

The Hybrid Model Problem

Chris: I learned that the hybrid model doesn’t work from a friend in the spa massage industry. Part of the IRS test is around core business. If you have employees doing a core business for you, doing the house cleaning, that’s part of your core revenue generating activities, and you also have a contractor do that, the IRS feels that that logically doesn’t make sense, because you would have to then classify those contractors as employees, because they’re doing the same core business as the employees are.

The only exception to that is overflow capacity. If you’re overflow capacity, I think there is some leeway with temporarily contracting things out to get work done.

Stephanie: That makes perfect sense, and gives me a lot of clarity, because that is something that I have suggested in the past, not knowing that maybe this is a good solution. I guess for overflow capacity it could work in that context. But overall, as a rule, makes perfect sense. You’re doing the same work. Why the different classifications?

Chris: Yes, that’s slightly above my pay grade, but I just remember the answer being, don’t do it.

Transitioning Between Models

Stephanie: If somebody’s looking to transition from independent contractors to W-2s or maybe vice versa, do you have any suggestions or have you seen that done successfully or perhaps unsuccessfully? What mistakes are we looking to avoid here?

Chris: That’s a hell of a last question to throw me. That’s a big one. I’ve talked with people about this a few times. You can do it, but it’s usually one way. You cannot go employees to contractors. You can go contractors to employees. It is so unlikely that you will be able to go from employees to contractors, I can safely say almost no employment lawyer will tell you to do that if you talk with them.

So the first thing is, if you want to make that transition, you need an employment lawyer. You cannot do this yourself. You will get tens or hundreds of thousands of dollars in penalties if you do this yourself. And that’s not an exaggeration. You need a really good employment lawyer who specifically has helped with this transition before.

Number two, it’s one way. If you transition from contractors to employees, you’re not going to go back again. So you have to be really sure that you understand what’s involved with an employee based cleaning model. And you should shadow employee based cleaning model owners, because supplies, training, quality control, checks, team leads, a lot of the stuff which was not relevant for you before, you’re going to have to learn very quickly how to do this compliantly.

Number three, you’re going to have to do your paperwork over again. You’re going to have to go to those professionally done. You’re going to have to make sure that they’re transitioned safely over in Gusto, or whoever your payroll provider is to employees.

There’s a lot here, Stephanie. The fourth one is, some of your teams are going to leave you if they like being contractors. So some of them are going to stay contractors, and they’re not going to go to employees. Some of them are going to want to be employees, and they’ll be thrilled about that opportunity, but you’re going to lose some of your teams.

And number five, as far as I understand it, you kind of have to do it all at once. You can’t do the hybrid temporarily that we talked about earlier and gradually transition over to employees. You got to transition over to employees, and that’s it. You’re not doing both at the same time, so it can really affect your schedule, and you might have to mass hire people.

The sixth would be, sorry, I know this is a long answer. Your business expenses are going to radically change. The monthly business expenses and taxes that you pay are very different between a contractor and employee model. So you need to make sure you understand all the extra business expenses that you’re going to have to pay, and how your profit margins are going to change, and how your pricing for your jobs is going to have to change for your clients as a result of this.

So it’s not just transitioning. It’s a radical transformation of the way that you do business on a fundamental level. The service, the pricing, the teams, the contracts, all of it is different. So when you embark on this transition, you can do it, but just recognize it’s a really long, expensive effort.

If you’re not being compliant, I will say this though, as a final thing, if you’ve been doing a contractor model, and you listen to our conversation today, and you had a few oh shit moments where you realized you really were not compliant, it pays dividends to make the transition to employees, because the IRS has a voluntary reclassification system where if you voluntarily go to them and say, hey look, I recognize I was not doing this properly, I’d like to transition them to employees proactively, they will reduce or eliminate most of the penalties that you would have to pay if they audited you and caught you.

So if you realize that you’ve been screwing this model up, it will pay a huge dividend. It’ll still be very expensive, but it’ll pay a huge dividend to proactively go with an employment lawyer and make this change with the IRS, and they will look very favorably upon you doing that. So that’s the last thing I would say, is there is a voluntary reemployment classification program you can take advantage of. So that was a lot.

Stephanie: Amazing answer. And I have two comments on two of those points. One, what you just said, if you’re not being compliant, for you guys watching this, and a lot of you guys are small owners, right? You just got a couple cleaners. And to me, it seems like if you are going to eventually go to W-2s, the smaller, the better, because you’re probably already not doing things correctly, based on everything we just talked about for the last hour. So I would rather you rip the band aid off before you grow even bigger, you know, and make this even more difficult. Wouldn’t you agree, Chris?

Chris: I would. And for anyone who thinks we can’t use this model, you should look at the first last podcast I did with Stephanie, because I believe we touched on this briefly. You can do this model. This is more of a slightly perhaps negative context of how to not screw it up, rather than how to do it successfully. So maybe we can do a part two sometime about how to do it properly. But you’re right. We should totally do this earlier rather than later. Because if you’re billing a million and a half dollars under a contractor model, and you’ve been doing this for 10 years, and now you realize you want to switch over, good luck to you.

You can do this properly, but definitely, if you screw up something, the earlier, the better, and change it.

Stephanie: The second, final thing I’ll say is exactly what you said of you’re going to have cleaners most likely leave when you do this transition, because it makes perfect sense. If they’re used to making $40 an hour, depending potentially on your split, and then all of a sudden, we’re dropping it down to reasonable W-2 wages, $25 an hour max, that’s a huge hit to them, despite the fact that the taxes and all of that are changing. Who’s supplying the tools and supplies? Either way, they’re going to see that number go down and freak out.

I think that a lot of them would not be able to see the benefit, especially if you are making this transition and you do not actually have any employment benefits. You don’t have health insurance yet. You don’t have a 401k. You don’t have any of these things that really entice the W-2 model that we can offer them. I couldn’t for years. So it would make sense that you’re going to have a big house cleaning of staff, if you will, or team, I should say, if this happens. So definitely something to be cognizant of if you are a larger team.

Business Emergency Fund Advice

Chris: Yes, and just add on to that quickly, it pays to have an emergency fund for your company. One of the things I’ve done with me and my students is we have a personal emergency fund for our personal finances. That’s very common in the personal finance world, but you should have a business emergency fund too that you slowly build up over time. And if you’re ever going to make this transition, you’ll be very happy, because you need a longer runway under the employment model to pay people with. You’re going to need more money in your bank if something goes wrong.

If you’re on a contractor model, and you need to temporarily pause your business, you just stop giving work to people, and you can pause your subscriptions, and then you have no expenses. But if you’re an employee model, with employees, you need to have a cushion, much bigger cushion under that model than you do under the contractor model. So I know that’s off topic Stephanie, but I just figured I’d put it on there.

Stephanie: I’m all for financial cushions.

Final Thoughts

Chris: If I may, I have a good way to summarize our chat. This whole contractor model, doing it correctly is contingent upon you recognizing the difference between rationalizing something and reasoning something. When we’re doing something the IRS clearly says is wrong or not, we need to reason. We need to think through what’s correct and what’s not. Most of the owners that do this model that I see are rationalizing their decisions retroactively. We’re doing it this way because it’s easier, and we’re trying to rationalize that this is compliant when it’s not.

If you can just take a step back and recognize the difference between reasoning and rationalizing your position when you use this model, that will go 90% of the way for you being compliant, I think, because everything is downstream of that recognition.

Stephanie: That was beautiful. Thank you for tying that for us on this episode, Chris. This has been a really great overview. We’re not trying to poo poo. We’re trying to protect you guys so that you don’t do things incorrectly. Clearly, it can be done. It can be done very successfully. Chris teaches a lot of people how to do this, and a lot of businesses can do this correctly. A lot of them just are not. And so that was the point of this whole conversation. And I’m really glad we got into the nuance of it all. Hopefully everybody watching is not about to throw themselves off a cliff because they realize that they’re doing it wrong.

Obviously, it is always a pleasure to talk to you. This has been a delight, and I know you have your Maid Summit talk coming up if this goes live before that. I’m really looking forward to that. What else do you got going on? You said you have a newsletter that you’re working on and putting out. What else do we got?

Chris: Sure, just a couple things. I run a program called the Local Business MBA, which is an MBA style program for home service business owners, particularly cleaning, because I’m obviously a cleaner, where I teach you systematically how to build a remote cleaning company. I’ve been doing this for about eight years now. I started my clean company 10 years ago. I started coaching shortly after.

So if you want to learn how to do this compliantly in the way that I recommend, and grow it stage by stage, you can find it at LocalBusinessMBA.com, and this is what we talked about now. These types of valuable discussions we have all the time with the other students. So I do that. And if someone needs one on one help, I do one on one coaching. Just email me, chris@localbusinessmba.com.

And then there’s the newsletter. So I recently started a weekly newsletter, which is really fun. It’s a lot more work than all the newsletter gurus tell you that it is, but it’s a lot of fun. There’s a lot of industry newsletters for marketers, for coaches, for a bunch of other industries, but there’s not many newsletters for the cleaning industry specifically.

So what I’m doing is I’m doing a weekly newsletter on cleaning, with a focus on remote, because that’s my angle, where I share industry news, where I share strategies and tactics for free that you can use. It goes out once a week on Tuesday. You can just find that in my Facebook bio, because I can’t read out the whole URL, but we can link it below in the description.

Stephanie: I’m definitely going to be subscribing to that, because you’re right. There is a total lack of that in our industry. So yeah, you’re doing a lot of great stuff, Chris, and everybody watching, Chris is the OG man. And I can’t tell you how much I admire you. And just your calm demeanor, to my spazziness is just, it’s a really nice balance, if you will. So you know yin and yang, right?

Chris: You’re a wonderful host. So thank you for jumping on. Stephanie, I follow you closely, so I suppose I’m speaking to the crowd, but if anyone’s listening, they’re obviously subscribed to you. Stephanie, so thanks.

Stephanie: Chris and everybody, give him a follow, subscribe, and we will see you on the next episode of Filthy Rich Cleaners. Bye.

Chris: Bye.

Note: This transcript has been edited for clarity and readability.

Resources Mentioned in This Episode

QUICK TIP FROM THE AUTHOR

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.