Brought to you by expert maid service owners

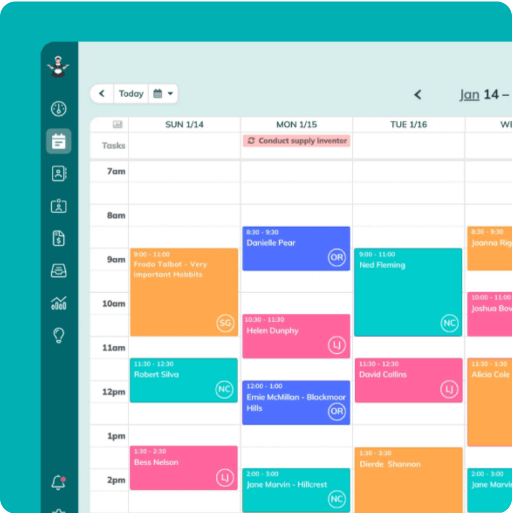

ZenMaid is the simple scheduling software that will help you save 30+ hours in your cleaning business every week. Join thousands of other cleaning business owners who now have time to take a nap, spend time with their family and take vacations! Start your free 14-day trial today to discover how many hours you can get back in your week.

Please note: This article is provided for informational purposes only and does not substitute for professional legal advice. Always consult with a financial and legal professional to address your specific needs and ensure you comply with the necessary regulations.

Are you dreaming of launching a successful entrepreneurial venture but need some legal help? One question might be lurking in your mind: “Is it legal to clean houses for cash?” Let’s dig into this a little deeper and clear the fog. This isn’t just about laws and regulations but also about building trust with your customers and fostering a profitable, lawful business.

Table of contents

- Is It Legal? Let’s Unpack the Facts

- Reporting Earnings: Showcasing Trust and Compliance

- Forms the IRS Will Examine: Staying Prepared as a Cleaning Business Owner

- Keeping Tax Obligations in Check

- Bring in the Experts: When to Seek Professional Help

- Beyond Cash: Exploring Other Payment Methods

- FAQs

- Wrapping Up

- Your next step

Is It Legal? Let’s Unpack the Facts

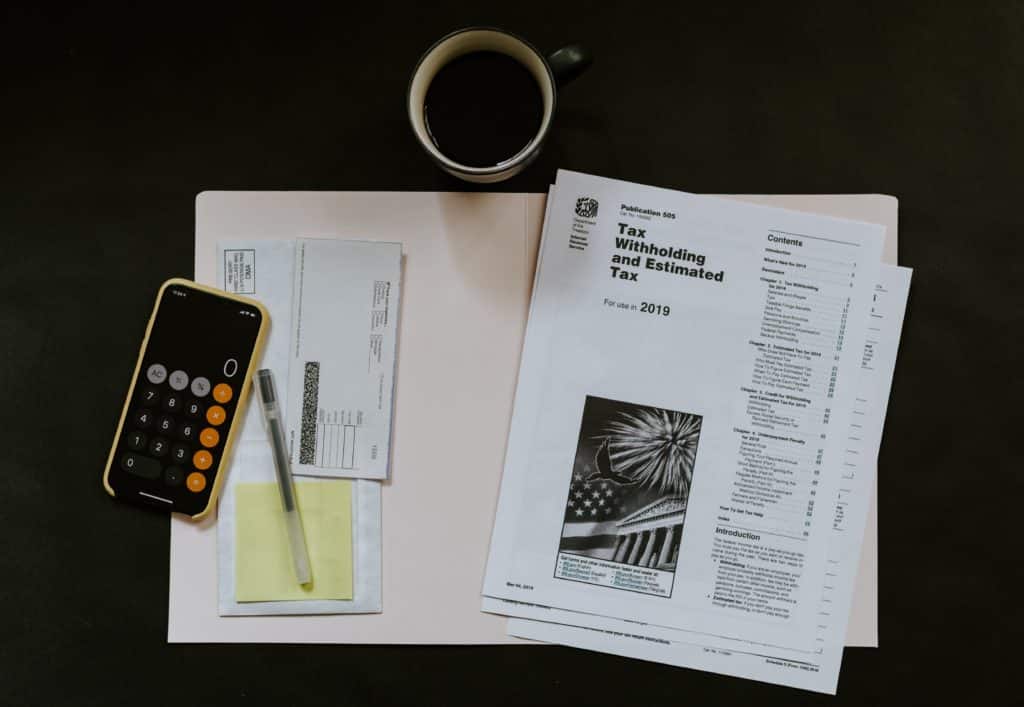

Tempting as it may be, accepting cash payments for your cleaning services without reporting them isn’t a shortcut you should be taking. Why? The wages you earn from sprucing up someone’s abode are taxable and must be disclosed to our friends at the Internal Revenue Service (IRS), the government tax authority. You don’t want to play hide and seek with them. Trust me, that’s a game you won’t win!

Neglecting to report your income can drag you into a quagmire of audits, penalties, and legal trouble. So, before you scrub your first floor, let’s understand how to keep your cleaning venture in good legal standing.

Reporting Earnings: Showcasing Trust and Compliance

It’s not just about legality; reporting your earnings is also a trust-building move. Tax laws are in place to ensure transparency in all our financial dealings. Wherever your cleaning venture takes root, it’s essential to report your earnings according to local tax laws.

Dedication to operating a legal and ethical cleaning business signals to potential customers that you’re trustworthy. This especially appeals to higher-income earners, prime targets for IRS audits. By doing things the right way, you avoid putting your clientele (and yourself) in a risky situation that might harm your reputation.

Forms the IRS Will Examine: Staying Prepared as a Cleaning Business Owner

Let’s take a look at the forms the IRS will examine. Stay prepared as a cleaning business owner by familiarizing yourself with these:

W-2 form: For employees, it shows that you’ve paid Medicare and Social Security taxes.

1099-Misc. form: For self-employed contractors.

Related Article: Should I hire contract cleaners or W-2 employees for my cleaning business?

Keeping Tax Obligations in Check

As your cleaning business grows and you hire additional staff, several taxes will come into play. Navigating this maze of tax obligations might feel overwhelming, so we’ve put together a list of the few main ones to be aware of. Always consult a knowledgeable accountant to help you stay on top of these obligations.

FICA tax: This stands for the Federal Insurance Contributions Act tax. It requires you to pay 15.3% of each employee’s total wages towards Social Security and Medicare.

FUTA tax: The Federal Unemployment Tax Act tax applies to the first $7,000 paid to each employee at a rate of 6%.

Unemployment taxes: These vary based on your locality and state. They help provide benefits for your employees.

Workers’ Compensation: This insurance protects your employees in case of job-related injuries or illnesses. Premiums fluctuate based on your location and the number of employees.

State or local income taxes: Depending on where you operate, your cleaning business may be subject to these.

At ZenMaid magazine, we have a “How To Start a Cleaning Business Guide” for all 50 United States. Go here to search for your state.

Related Article: Cleaning Business Insurance and Bonding: What you need to know [2023 Guide]

Bring in the Experts: When to Seek Professional Help

Think about it: you wouldn’t ask your accountant to clean a bathroom, right? So, why take on accounting tasks when you’re an expert cleaner? A seasoned accountant can sail you through the stormy seas of tax laws and ensure accurate reporting. Having a financial advisor in your corner allows you to focus on what you do best: providing top-notch cleaning services.

Just as you offer your expert cleaning services to clients who need help tidying up, don’t hesitate to reach out to an accounting professional when you need assistance navigating your business’s finances. Here’s when you might need to bring in the experts:

1. Deciphering the Tax Code:

The tax code is complex, and understanding it requires significant expertise. An accountant can help you understand how the code applies to your specific situation, ensuring you don’t miss out on any deductions or credits you’re eligible for.

2. Filing Your Taxes:

Filing taxes can be a headache, especially when juggling a growing business’s demands. A professional can help you file accurately and on time, minimizing the risk of penalties or audits.

3. Bookkeeping:

Proper bookkeeping is essential for any business. An accountant can help you track income and expenses, monitor your cash flow, and provide valuable financial insights.

4. Compliance:

Compliance with local, state, and federal tax laws is crucial. An accountant can keep you up-to-date on any changes to these laws and ensure your business stays in compliance.

QUICK TIP FROM THE AUTHOR

Simplify and enjoy your scheduling with a scheduling software made for maid services

- Have a beautiful calendar that's full but never stressful.

- Make your cleaners happy and provide all the information they need at their fingertips.

- Convert more website visitors into leads and get new cleanings in your inbox with high-converting booking forms.

- Become part of a community of 8000+ cheering maid service owners just like you.

Start your FREE ZenMaid trial today and discover the freedom and clarity that ZenMaid can bring to your maid service! Start your FREE trial today

Beyond Cash: Exploring Other Payment Methods

While cash might seem like the simplest way to get paid, modern technology offers a wealth of other options. Mobile payment platforms, credit/debit cards, and electronic funds transfers are becoming increasingly popular. These payment methods are traceable, which can help prove income when it comes time to file taxes. They also offer a level of convenience and security that cash simply can’t match.

Adopting these technologies can boost your cleaning business’s professionalism and make things easier for your customers. Remember to include any fees associated with these payment methods when pricing your services.

FAQs

Is it acceptable to accept cash payments for house cleaning services?

Yes, it’s permissible to accept cash as a form of payment for cleaning services. However, it’s crucial that this income is appropriately declared to the government, as it is considered taxable income.

What are the potential consequences of not declaring my income?

Failing to declare your income can result in serious repercussions, including IRS audits, penalties, and potential legal consequences. Staying compliant with tax regulations is key to maintaining a reputable business.

Why should I declare my earnings?

Declaring your earnings is not just a legal requirement but also promotes trust and transparency with your clients. Additionally, it ensures your business’s long-term financial stability and legal compliance.

As the owner of a cleaning business, what taxes should I be aware of?

Running a cleaning business, you should be mindful of various taxes, including FICA, FUTA, unemployment, workers’ compensation, and any applicable state or local income taxes. It’s strongly advised to consult with a tax professional to fully understand your specific tax obligations.

Who can assist me with financial management and tax compliance?

We recommend employing a trusted local accountant. Accountants can guide you through the complexities of tax regulations, help manage your financial records and ensure that your business is operating within the bounds of the law.

What are the advantages of not dealing strictly in cash?

Adopting diverse payment methods and accurately reporting income opens doors to long-term benefits. This includes the ability to contribute to insurance and unemployment taxes, providing a safety net for you and your team. Moreover, your contributions towards social security taxes support your employees’ long-term financial well-being.

How can I attract high-quality clients for my cleaning business?

Building a quality client base involves identifying your target clientele and aligning your marketing efforts accordingly. Engage in local community events and join business networking groups. Always communicate your commitment to lawful business practices, including the non-acceptance of cash payments.

Which IRS forms are relevant to my cleaning business?

If you employ staff, W-2 forms for each employee are necessary, demonstrating your payment of required Medicare and Social Security taxes. Depending on your state, additional forms relating to overtime payments and income specifics may also be required.

How can I locate a reputable accountant for my cleaning business?

Recommendations from other local businesses can be a great starting point for finding a reliable accountant. Online research can help you discover local accountants whose pricing and services align with your needs.

Are there any deductions available for my cleaning business?

Absolutely, your cleaning business may be eligible for several write-offs, including costs related to cleaning supplies, insurance, licensing, fuel or mileage, maintenance, and uniforms. To understand which expenses can be claimed in your situation, consult with your accountant.

Wrapping Up

So there you have it: Cleaning houses for cash is indeed legal, but running an under-the-table operation that fails to report earnings to the IRS is not. To build a successful cleaning business, ensure that you understand your tax obligations and report your earnings accurately. Hire an accountant if you’re unsure about navigating tax laws, and consider offering modern, traceable payment methods in addition to cash. By operating within the law and prioritizing transparency and professionalism, your business will be up for long-term success!

Your next step

If you found this article helpful for your maid service, you may also like:

- Stop Overpaying: How to Save $10K+ a Year in Your Cleaning Business

- How One Cleaning Tech Employee Becomes Irreplaceable

- What I Wish I Had in Place *Before* My First Nightmare Client

- The Divorced, Broke, and Fearless Journey to Six-Figure Vacation Rental Success

- How a 20-Year Cleaning Business *Drastically* Increased Revenue by Ditching Pen and Paper

Make sure you’re on our email list to find out how to get free tickets to the next event.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.

Frustrated with your scheduling? Try the easiest-to-use calendar app, made by and for maid service owners.